The Australian corporate financing sector has undergone dramatic changes in recent years. Australian businesses typically finance their investments through a combination of internal sources and external sources. The external sources include traditional banks and financial institutions, while internal sources are company funds (a.k.a. cash flows). The global financial crisis of 2008 resulted in a tightening of credit lines from traditional sources. Small and medium-sized businesses (SMBs) in Australia were subject to increasingly stringent requirements vis-à-vis paperwork, qualifying criteria, and associated information. Bank approval is also a lengthy process which is dependent on multiple checks and balances along the way.

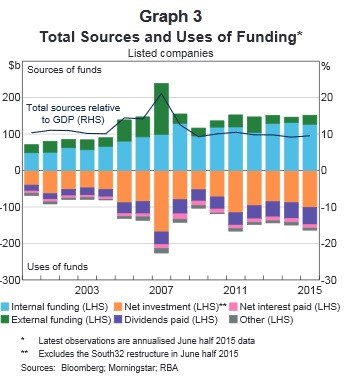

Research conducted by the Reserve Bank of Australia, Morningstar, and Bloomberg indicates that internal sources of funding for Australian businesses have increased since 2007. That figure is now hovering between 10% and 20% of all funds invested in companies. External sources of funding through banks have whipsawed somewhat since 2007 when they were at multiyear highs. Since the global financial crisis, the amount of funding approved by traditional banks and financial institutions has decreased sharply, notably between 2011 – 2015. However, borrowing has continued as Australian businesses expand operations domestically and abroad.

Internal funding has superseded external funding since 2008. This is known as the ‘post crisis phase’ of financing for Australian businesses. Between 2007 – 2015, the prices of global commodities dropped dramatically. Since many Australian listed companies are involved in commodity exports, this put a damper on profitability and decreased ROI. With lower cash flows, companies had to find other ways to re-invest their funds. Divestitures, mergers, acquisitions, and debt-fueled financing have driven company investments. It’s important to understand the costs of external financing activities. Overall, the RBA found that companies which dabble in resources management tend to finance their activity from internal sources. When debt/finance investments are evaluated, external financing is typically used. Australian businesses tend to have a low degree of leverage, since internal funding through cash flows and re-invested profits is on the rise.

Are FinTech Financial Corporations Making a Splash in Australia?

There has been a notable tightening of credit markets in Australia since 2007. However, that has facilitated the rise of alternative lending in the form of FinTech financial corporations. Otherwise known as non-bank corporate lending, the Australian economic landscape is now rife with a selection of leading market players.

The financial technology companies which are making a big impact in the land down under include P2P lending, P2P banking, mobile payment solutions, insurtech and cryptocurrency/blockchain technology. The efficacy of FinTech lending to corporates in Australia is evident throughout the island nation. Small Business Loans Australia is an aggregator platform that provides Australian businesses (Small and Medium Businesses) with access to a variety of non-bank lenders with high credibility and customer satisfaction ratings.

Banks find it difficult to compete with the quick & easy application and approval processes that FinTech companies can provide. For many SMBs in Australia, it’s difficult to provide a detailed history of business activity/credit profiles. Additionally, a business that does not have a substantial asset base will find it challenging to be approved by a traditional bank. Fortunately, these are not the requirements of many corporate lenders in the FinTech space. The simplification of application processes, and the shortened processing times have also allowed for more Australian businesses to get up and running and start generating profits. These are the most important benefits of the burgeoning FinTech boom in corporate financing.