(Table | courtesy of Ferguson Wellman)

Each year financial experts look into their hazy crystal balls to determine what is going to happen in the markets and economy in the coming year. Obviously, the past couple of years have been nothing short of extraordinary for the world, but we believe the extraordinary stimulus that our central bank and government have enacted will no longer be necessary in 2022. That means the Fed will be raising interest rates in 2022, and Congress will be offering much less fiscal stimulus. What does that mean for the national economy and more importantly, what does that mean for Central Oregon’s economy?

We believe the U.S. economy will grow in 2022 in the range of four to five percent, although growth will be a little slower than that in the first quarter with the onset of COVID policies associated with the Omicron variant. We feel the same about Central Oregon’s growth rate as well, strong growth for the year, with some slowdown in the first quarter.

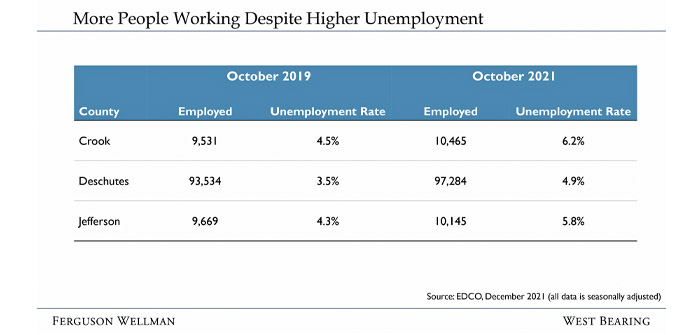

The biggest issue facing the U.S. economy is finding workers. That’s obviously the same in a region where unemployment rates are higher than pre-pandemic levels, but workers are harder to find.

This is one of the unique characteristics of this recovery. People retired in record numbers, some are still afraid to come back to work because of COVID, while others simply don’t have proper childcare options. All of that being said, it may be hard to believe our region actually employs more people today than before the pandemic, unlike national averages. That tells us people have been moving to the area, but have been slow to take jobs for the reasons explained above. These trends will soften in 2022, and more people will find their way into the workforce. Nevertheless, wage pressures will continue to rise in the first half of the year.

Which leads us to inflation. For the first time in decades consumers and businesses are faced with real inflation. It’s not a surprise when you think of how much our community’s options were restricted for a couple of years, which resulted in money to spend. Spending on services dropped, but all of that cash went to buying more goods. Inflation is, “too much money, chasing too few goods.” We believe supply chains will recover in 2022, and this should relieve some of the inflationary pressures facing the country.

One area we don’t think we will be so lucky will be rent growth. The housing market was ground zero for the 2008 Great Financial Crisis. This led to years of underinvestment and underdevelopment of homes across the country. This was no different in Central Oregon. Multifamily and single-family home construction slowly recovered following the financial crisis, but never really caught up to new household formations. When the pandemic hit, construction stopped for a brief period, and then really ramped up again, but we’ve never caught up to the curve. Couple that with a change in behaviors associated with the pandemic, and you have a recipe for inflation: too many renters (i.e., too much money), chasing too few goods (i.e., apartments or homes).

As we think of our region in relation to the rest of the country, it’s hard not to be optimistic. Central Oregon already has more people working than before the pandemic, yet more people are unemployed than prior to the pandemic. We see that has built in growth and opportunity. Housing and rent inflation will continue to be an issue, because it takes a long time to build that infrastructure, which means employers are going to have to pay more for workers, and how much of those costs they can pass on remains to be seen.

Ferguson Wellman is a 47-year-old registered investment adviser serving multigenerational families and nonprofits. The firm manages $8.2 billion for 913 clients with assets starting at $4 million. Its division, West Bearing Investments, has a minimum of $1 million. More than $160 million of the firm’s assets are managed for clients residing in Central Oregon. (Data as of 12/31/2021)