If you want to stay on top of the market and eventually watch your investments double and even triple, you have to start from the beginning and understand the basics. To thrive in the financial world, it’s crucial to be aware of what potential roadblocks can arise.

By the end of this article, you will have had financial bubbles explained to you, had flash crashes defined, learned the causes of some of the most well-known financial crises, and, hopefully, taken the first step towards financial success.

What is a Financial Crisis

A FINANCIAL CRISIS is an event where certain financial assets suddenly lose a large percentage of their value. Many different situations could be considered a financial crisis.

There are multiple causes of a financial crisis – for example, both financial bubbles and flash crashes can lead to crises. A notable example of a financial crisis is:

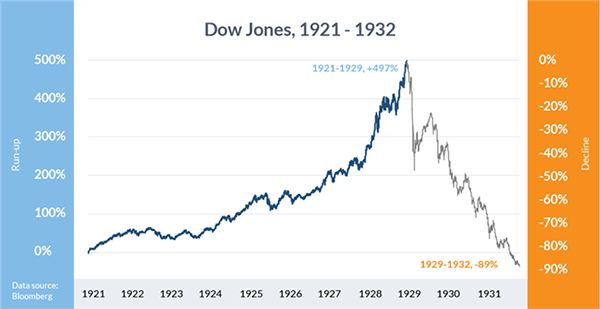

- The Great Depression – The Great Depression is one of the most well-known American financial crises. It came about due to the collapse of stock market prices. During this recession, which lasted for more than three and a half years, unemployment rose to nearly 25%. Experts have called it the ‘worst economic downturn in the history of the industrialized world’.

The fall of Dow Jones, which was part of the cause of the Great Depression

What is a Financial Bubble?

A FINANCIAL BUBBLE is when asset prices rapidly expand to well above the norm or the commodity’s value. The final outcome of a financial bubble tends to be the prices dropping again, usually unexpectedly.

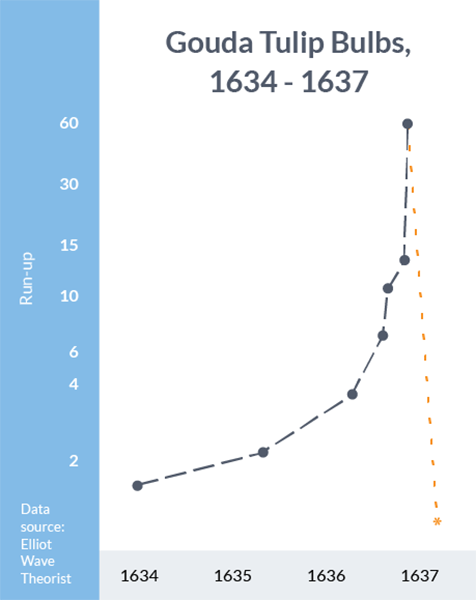

A notable example of a financial bubble is:

- The Tulip Mania – The tulip mania is perhaps the first recorded example of a financial bubble. During the seventeenth century, tulip bulbs became so popular and coveted that the prices drastically spiked. At the height of this mania in 1636 and 1637, a single bulb could be sold for over 10 times the annual income of a skilled craftsperson of the time. However, the flower bulbs’ expensive popularity was short-lived and soon, partially due to a large number of people purchasing bulbs on credit, the price collapsed and trade ground to a halt.

What is a Flash Crash?

A FLASH CRASH happens when the price of a security (such as a cryptocurrency, traditional currency, stock or bond) quickly decreases in value. This typically occurs over a short period of time, and it doesn’t take long to enter a recovery period.

Fash crashes can be caused by humans and computers alike and have been more frequent since the rise of automatic trading. A notable example of a flash crash is:

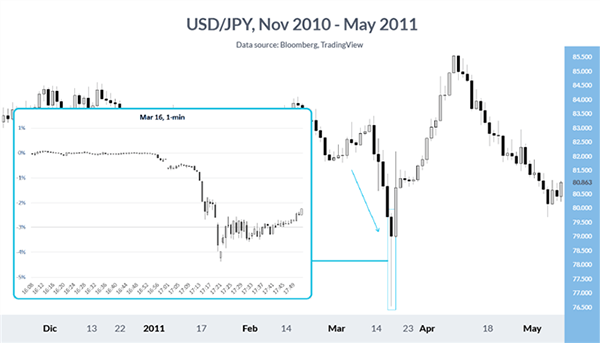

- USD/JPY and AUD/USD – In January of this year, many traders began to sell out and avoid dealing with China and other riskier currencies after Apple released a statement saying that the Chinese economy was weakening. China’s key trading partners, specifically Australia, began to feel the negative effects when investors put more and more of their money into Japanese yen. AUD/JPY fell dramatically over the course of minutes, which, due to foreign exchange, impacted other countries. For example, this caused the Japanese yen to become stronger than the US dollar.

An example of a flash crash from 2010/2011 that also involved USD/JPY

You can learn more about notable flash crashes and how future ones can be prevented here.

From flash crashes to bubbles waiting to burst, the world of finance is full of risk. However, that also means that there are many opportunities for reward. Now that you are armed with the knowledge of the definitions of various financial crises and some past examples, you are well on your way to learning how to make better informed decisions when it comes to investing – and perhaps reaping the benefits of some of those aforementioned rewards.