(Graph courtesy of Windermere Commercial Real Estate)

Warren Buffet is a controversial but wildly successful investor. He says, “Economists are tripping over each other today to predict what the seven people in the U.S. Federal Reserve will do. But in the end, everyone’s guessing.” The better way, Buffett proposes, is to “Prepare, and not predict. Predicting rain doesn’t count. Building arks does. Uncertainty is the friend of the one who invests in long-term value.”

Intuition and public perception say it is not the right time to build spec commercial space but in these uncertain times, here are some indicators that this is the right time to build long-term value.

Demand for Commercial Space in Central Oregon

Redmond is reporting five new residents arriving every day and the local three counties are in the top five fastest-growing counties in the State. The rapid increase in population creates an increased demand for all commercial services. Eric Sande, executive director of Redmond Chamber of Commerce recently reported 101 new business members in the Redmond Chamber compared to 49 new members in 2021. Chuck Arnold with Redmond Urban Renewal Agency recently announced that 17 new businesses in the retail/restaurant/service sector opened in the Urban Renewal District in 2022. Occupancy rates went from 88 percent in 2021 to 94 percent in 2022. The City is preparing for 50,000 new residents in the next ten years.

Limited Availability

The availability of industrial space throughout Central Oregon is basically zero. There is some availability of large spaces that creates a statistical two to three percent vacancy but as a practical matter, they are not suitable for most businesses. There are new projects coming online in the next few months but not at the pace to meet demand. Even the retail sector which is reportedly in a decline has a shortage of space in certain locations where businesses want to be.

Factors Affecting Feasibility

The solution to this dilemma in Central Oregon is to build more space for commercial users. Here are a few factors that make new projects feasible:

Lease Rates

Keep in mind the difference between existing tenant rates and new building lease rates. Existing tenants may have signed a lease three to five years ago when the demand was much different. New building lease rates reflect the actual costs that need to be covered including a profitability factor that makes it a viable investment for the developer. In Redmond, for example, there are existing industrial building tenants paying under $1.00/sf whereas new building lease rates will be more in the $1.15 to $1.25 range.

Interest Rates

While inflation is at a 40-year high, interest rates are nowhere near the 2000’s rate of 6.5 percent, much less the record high of nearly 20 percent in 1980.

Mike Kraft, Head of CRE Treasury at JPMorgan Chase says, “In terms of absolute levels, and in view of history, current interest rates are still at attractive levels. Generally, I would say this is a great time to do business — before additional rate movements kick in.”

Building Materials

The demand for lumber is starting to cool down. Q1 of 2022 saw lumber prices well above the $1,000/MBF mark. Currently, lumber prices are well below $600/MBF, which is almost back to pre-COVID levels.

Many believe the worst of the “wild lumber ride” is over and prices will continue to slowly decline, bottoming out around the $450/MBF mark in 2023. Consumers might not see this at the lumber yard until new inventory starts to migrate in.

Steel, HVAC, plumbing, wiring and roofing costs, on the whole, have risen over 30 percent from early 2020 into 2022 mostly caused by the impact of the war in Ukraine. However, with worldwide slowdown of demand, prices are receding and expected to stabilize going into the new year.

Land Costs and Repurposing

If you are an investor who bought land in preparation for a project, you are in the best position because one of your major costs are now below market price. If you still need land for your project, consider looking at some of the smaller cities in the tri-county area where costs are considerably lower.

Consider repurposing property you already own like Gary Diefenderfer with JAFHR Development, Inc. He owns a Redmond rental home in an area zoned MULW that allows industrial use if combined with residential space. Gary says:

“My proposed project will be a live-work building designed with a ground level for light industrial bays, including loading docks and open to facilitate receiving supplies and shipping finished products.

When completed, it will be a pioneer project for Redmond. I’m proposing a European idea that will eliminate the work commute.”

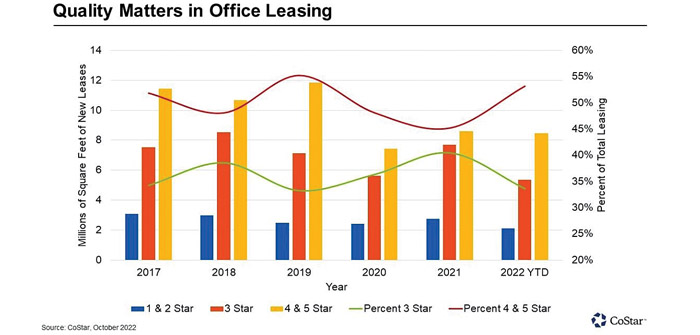

Also, consider commercial building repurposing. New tenants are paying premium lease rates for buildings that have amenities like new HVAC systems that improve the quality of the inside air. Improve conveniences such as plugins for electric vehicles and secure bike storage areas. Better windows, insulation and lighting will lower utility costs and the building can be advertised as energy efficient. Statistics show that demand is highest for quality buildings that feature amenities that are important to tenants.

Now most certainly is the right time to roll out new commercial projects if some important elements are in place. As Buffet says, “In times of uncertainty, invest in long-term value.”

Demand is strongest for high-quality space with amenities that tenants desire.