The great Albert Einstein published more than 300 scientific papers and developed endless formulas including the theory of relativity. In 1921 he received the Nobel Prize in Physics. His great intelligence and originality have made the word “Einstein” synonymous with genius. What I find most interesting is with all the theories, formulas and principles that he developed he stated: Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it. That’s exactly what many are doing with those looming credit card bills and student loans. And that’s exactly why it imperative to figure out how to pay those off so you can earn compound interest rather than pay it.

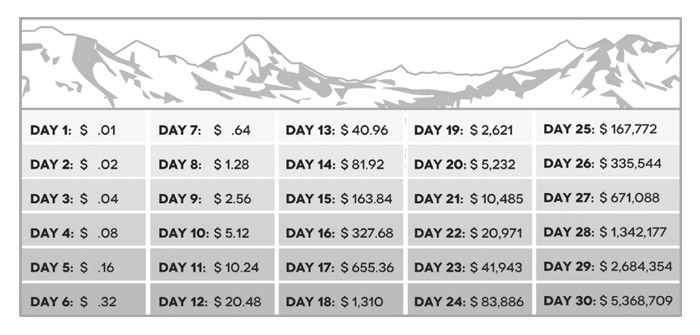

I find this concept incredibly important when it comes to planning your financial future. Compound interest arises when interest is added to the principal, so that from that moment on, the interest that has been added also itself earns interest. This addition of interest to the principal is called compounding. I have a question for you that will help you understand why Einstein felt compounding is so powerful. If you were given a choice to receive one million dollars in one month or a penny doubled every day for 30 days, which one would you choose? Almost everyone would choose the million dollars. Let’s look at the alternative:

This exercise offers quite astonishing results and a remarkable difference once you realize that you would be receiving over 5 million dollars with a penny doubled every day for 30 days. This is the power of compounding! If you had missed the last five days, you would have ended up with only $335,544 instead of $5,368,709. Therefore, it is imperative to start planning and investing early in life. Investing is like a rocket ship taking off into space. It spends 80 percent of its fuel during takeoff and once it reaches a certain point it flies smoothly with minimal consumption.

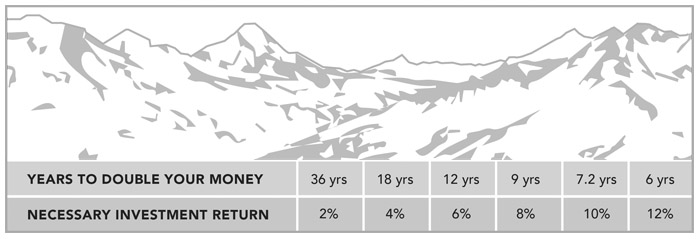

One of the handiest financial formulas that I use on a daily basis is also attributed to Albert Einstein. The “Law of 72” is an effortless way to calculate approximately how quickly your money will double at a given rate of return.

Here’s how it works:

Simply divide 72 by the annual rate of return you expect on your investment. Let’s say you invest $100,000 in an investment earning a hypothetical six percent annually. According to the equation, (72 divided by 6), your investment would double to approximately $200,000 in 12 years. If your investment earns 8 percent a year, it would only take about 9 years to double your money (72 divided by 8).

My intention is that knowing the powerful effects of compounding and the “Law of 72” will motivate you to teach your children to invest early in life. You also never know when you can impress your family and friends by asking them the doubling penny question or by running instant figures in your head on how long it takes to double an investment at a particular rate of return. Good luck and happy investing!

David Rosell is president of Rosell Wealth Management in Bend. www.RosellWealthManagement.com. He is the author of Failure is Not an Option- Creating Certainty in the Uncertainty of Retirement and Keep Climbing — A Millennial’s Guide to Financial Planning. Ask for David’s book at Newport Market, Sintra Restaurant, Bluebird Coffee Shop, Dudley’s Bookshop, Roundabout Books, Sunriver Resort, Amazon.com or Barnes & Noble

Investment advisory services offered through Valmark Advisers, Inc. an SEC Registered Investment Advisor

Securities offered through Valmark Securities, Inc. Member FINRA, SIPC 130 Springside Drive, Ste 300 Akron, Ohio 44333-2431. 800-765-5201. Rosell Wealth Management is a separate entity from Valmark Securities, Inc. and Valmark Advisers, Inc.