(Graphic | Courtesy of Oregon FBI)

This warning comes to us thanks to our partners at the Internal Revenue Service Criminal Investigation Division. Millions of American families started receiving the advance Child Tax Credit payments last month. If you get a phone call, email or text message or see a social media post offering help you get these payments, watch out.

Any communication offering assistance to sign up for the Child Tax Credit or to speed up the monthly payments is likely a scam. When receiving unsolicited calls or messages, taxpayers should not provide personal information, click on links or open attachments as this may lead to money loss, tax-related fraud and identity theft.

Although scammers constantly come up with new schemes to try to catch taxpayers off-guard, there are simple ways to identify if it is truly the IRS reaching out.

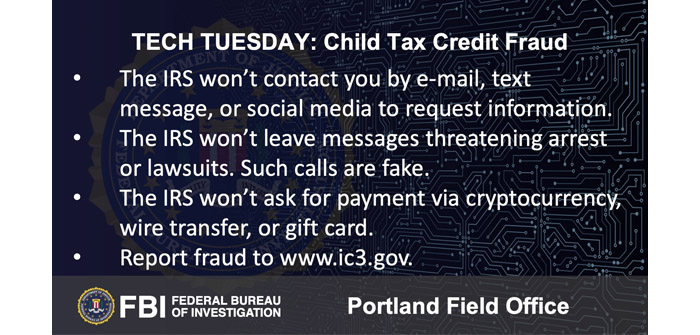

- The IRS does not initiate contact with taxpayers via e-mail, text messages or social media channels to request personal or financial information, even information related to the Child Tax Credit.

- The IRS does not leave pre-recorded, urgent or threatening messages. Aggressive calls warning taxpayers about a lawsuit or arrest are fake.

- The IRS will not call taxpayers asking them to provide or verify financial information so they can obtain the monthly Child Tax Credit payments.

- The IRS will not ask for payment via a gift card, wire transfer or cryptocurrency.

For taxpayers eligible for advance payments of the Child Tax Credit, the IRS will use information from their 2020 or 2019 tax return to automatically enroll them for advance payments. Taxpayers do not have to take any additional action. To report suspicious IRS-related phishing and online scams, visit irs.gov.

If you are the victim of any other online fraud, you should also report the incident to the FBI’s Internet Crime Complaint Center at ic3.gov or call your FBI local office.