Welcome to the Oregon FBI’s Tech Tuesday segment. This week: building a digital defense against synthetic ID theft.

Earlier this month, the FBI issued a warning against this particular kind of ID theft — a fraud that is difficult to identify but easy to stop, if you do a little work ahead of time.

Synthetic identity theft differs from traditional ID theft in that criminals don’t steal a single person’s identity — they create one using a combination of real and fake information.

When they use that identity to apply for credit, the credit reporting agencies generate a new credit file as though for a new person.

How do the fraudsters get started? The easiest way is to steal and use Social Security numbers for people who don’t already have credit files: our children. They then combine those clean Social Security numbers with information such as fake names and birth dates.

That persona then starts applying for credit and keeps going until a bank or business opens an account. Using that fake credit file and the very real Social Security number, the imposter can also get a job, file for a fraudulent tax return or even get medical benefits. Oftentimes, the lender is not aware of the fraud until the criminal maxes out the credit line and the account goes into default.

Unfortunately for the child whose Social Security number got stolen, it may not be until he or she is applying for financial aid for college that he or she becomes aware that a fraudster damaged his or her credit years prior.

So how do you protect your kids?

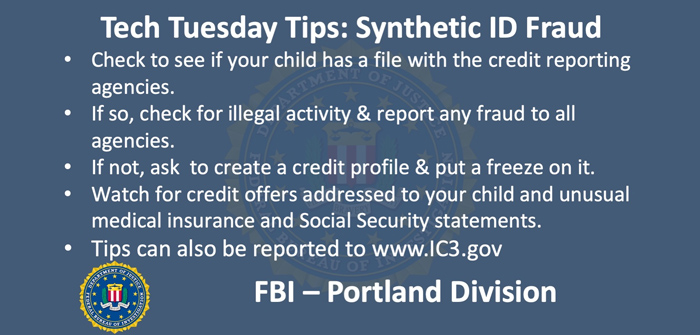

Check to see if your children have credit reports. They should not have reports, and if they do, that may be an indicator that someone has used their info.

To do this, you will need to check with the three major credit reporting agencies: Experian, TransUnion and Equifax. Each has its own requirements, but, generally, you will need to provide the child’s legal name, address, birth date, a copy of the child’s birth certificate and a copy of the child’s Social Security card. You will also need to provide proof about yourself such as a copy of your driver’s license and a copy of a current utility bill with your address.

If you find that your child does have a credit report, check it for illegal activity and report any fraud to all of the credit agencies.

If you find that your child does not have a credit report, you can ask that each of the three agencies create a profile.

Whether your child already had a profile or you ask to have one created, you can put a freeze on that credit file. Putting a freeze on a child’s account requires you to fill out a form or write a letter and provide all of the documentation we talked about previously. Check each credit bureau’s website for specifics as to what that particular bureau requires.

Federal law requires credit agencies to allow parents and guardians to place these freezes for free for children 15 and under. Those who are 16 or 17 can do so for themselves.

As an alternative to freezing, you can put your child on as an authorized user for one of your credit accounts. This will create a credit profile for that child and help establish the child as a legitimate owner of her Social Security number. If you go this route, make sure that you continue to run credit reports for your child; each person is allowed one free credit report per year from each of the three agencies.

Finally, watch for credit offers in the mail addressed to your child, unusual activity on medical insurance statements and the appropriate reporting of income on annual Social Security statements. Anything out of the ordinary in these venues could indicate a problem.

If you have been victimized by an online scam or any other cyber fraud, be sure to report it to the FBI’s Internet Crime Complaint Center at IC3.gov or call your local FBI office.