There are lots of new apps these days that allow you to instantaneously pay friends and family for your share of dinner, a movie or the upcoming summer vacation. With all of this technology, checks might seem like an ancient form of payment. However, checks are still popular with consumers and, of course, scammers. In fact, the FBI’s Internet Crime Complaint Center — or IC3.gov — is reporting a rise in in the number of Oregonians who say they’ve been hit by a check cashing scam.

Here is how the fraud works: Imagine you have a stereo that you have been needing to get off your hands for months. Garage sales can be so much work that you decide to try selling the stereo online. A few hours after posting it, you get an offer from a potential buyer. The buyer says that he will send you a check as payment for the stereo. At this point, the scam can go one of two ways:

- After receiving the check from the ‘buyer’, you send the stereo, only to discover later that the check you received was fraudulent.

- After receiving the check from the ‘buyer’, the ‘buyer’ claims that he changed his mind about the purchase and asks for a refund. The victim then sends legitimate funds as refund before discovering that the initial check had been fraudulent.

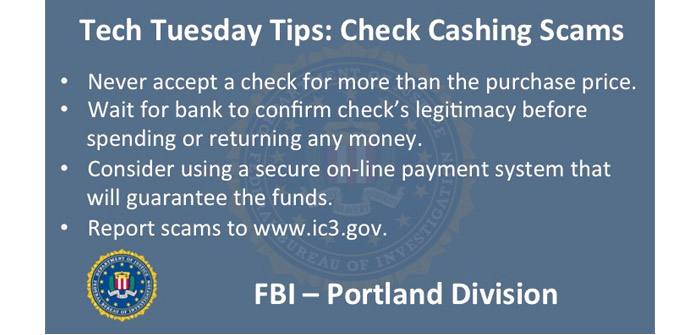

While both versions of this scam are prevalent, it is the second option that Oregonians are reporting more frequently. Our friends at the Federal Trade Commission have some tips on how to avoid becoming a victim:

- Never take a check for more than your selling price.

- Never send money back to someone who sent you a check.

- The law requires banks to make deposited funds available quickly. However, just because the check has cleared does not mean that it is good. It will sometimes take the bank days to learn that a check is bad.

- If you are selling online, consider using a secure online payment service.

If you have been victimized by this online scam or any other cyber fraud, be sure to report it to the FBI’s Internet Crime Complaint Center at IC3.gov or call your local FBI office.