This week we continue our series on building a digital defense against frauds targeting senior citizens.

A recent law enforcement operation to target those who prey on elderly Americans shows that the victims lost more than three-quarters of a billion dollars in the past year. That sweep — announced a few weeks ago by the FBI and the Department of Justice — involved more than two million victims, most of them aged 60 and older.

Last week, we talked about a common scheme in which criminals target seniors in tech support scams. This week — another popular scam — money mules.

When a criminal wants to add layers of protection between a victim and himself, he will use a money mule. The money mule is a person who acts as a middle-man – either knowingly or unknowingly transferring illegally-acquired money on behalf of or at the direction of another. The mule makes it easier for the criminal to mask his identity, move money out of the U.S., and evade scrutiny by banks. The scam can work a couple different ways:

In one variation, a scam artist targets a senior with any one of a thousand frauds. When the victim sends the money, he actually sends it to the money mule who then transfers the funds to the criminal. The victim definitely loses money in this scenario.

In another variation, the victim is the money mule. In most cases, seniors targeted in this way don’t know that they are involved in a larger criminal scheme. In this scenario, other victims send the senior citizen funds, which he then transfers to someone he thinks is a love interest or business partner. In this case, the mule himself may or may not lose money.

Seniors are particularly vulnerable to money mule scams because they tend to be more trusting; may be lonely or spend a great deal of time alone; or have diminished physical or mental capacity.

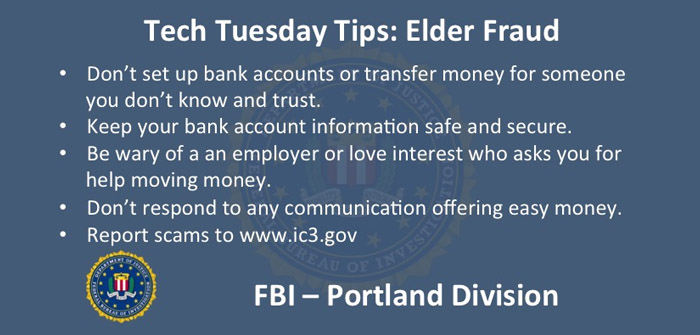

Here’s how you can protect yourself and family members:

- Don’t agree to set up a bank account for someone you don’t know and trust.

- Don’t give out your own bank account information or use your own account to transfer money for other people. No legitimate business will ask you to do this.

- Don’t respond to unsolicited emails, texts, calls or social media messages offering easy money.

- Be wary of an employer or love interest who asks you to transfer money and offers you the opportunity to keep a portion for yourself.

- Be suspicious of any online romance in which your new love asks for money or asks for help moving money.

Next week, we will continue to focus on elder fraud with a look at the problem of real estate frauds.

If you have been victimized by an online scam, report your suspicious contacts to the FBI. You can file an online report at the FBI’s Internet Crime Complaint Center at www.ic3.gov or call your FBI local office.