Last week we talked about how to spot fraudulent tax preparers. This week — some other scams where criminals are taking advantage of the confusion around the new tax law to dig into your pocketbook.

Fraudsters are always going to target those who are the most trusting or the most fearful. Seniors and vulnerable populations — particularly new immigrants — are especially at risk.

In one scam, victims get calls or emails from someone pretending to be from the IRS. For those with limited English proficiency, the fraudster may even approach the victim in her native language. The fraudsters are even good at spoofing the IRS’ phone number to make it look like a legitimate call.

Victims are told they owe money to the IRS and must pay right away to avoid arrest, deportation, or suspension of a business or driver’s license. The caller often suggests the victim pay the fake debt with gift cards or wire transfers. In some instances, they will demand the victim’s credit or debit card number over the phone to settle the debt immediately.

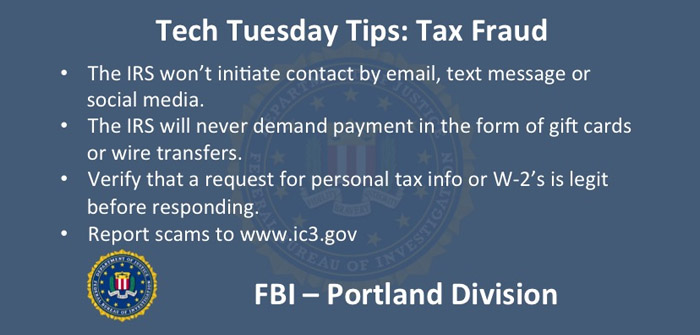

With regards to any concerns about your taxes, know that the IRS will never initiate contact with you by e-mail, text message, or social media. IRS officials will not call to demand immediate payment, nor will they demand that you pay without the opportunity to ask questions or file an appeal. If the IRS is trying to collect a debt or audit you, they will always attempt to contact you by mail first.

If you have any questions about a suspected fraud, contact the IRS.

Another scam to watch out for involves phishing attacks, and we mean phishing with a “ph”. This kind of fraud involves someone trying to get you to click on a link, photo or attachment in an email, text or post. If you do click on a bad link, you could end up downloading malware onto your computer which opens up all your info (or your clients’ info) to the fraudster. This can happen to both individuals and tax preparers who aren’t careful.

In another version of a phishing scam, the criminal pretends to be an executive at any given company. He sends an email to the HR department requesting employees’ personal information or their W-2’s, allegedly for tax or audit purposes. In some cases, the fraudsters have been able to cause a massive data dump affecting thousands of employees. Bottom line on phishing – don’t click!

If you have been victimized by this online scam or any other cyber fraud, be sure to also report it to the FBI’s Internet Crime Complaint Center at ic3.gov or call your local FBI office.