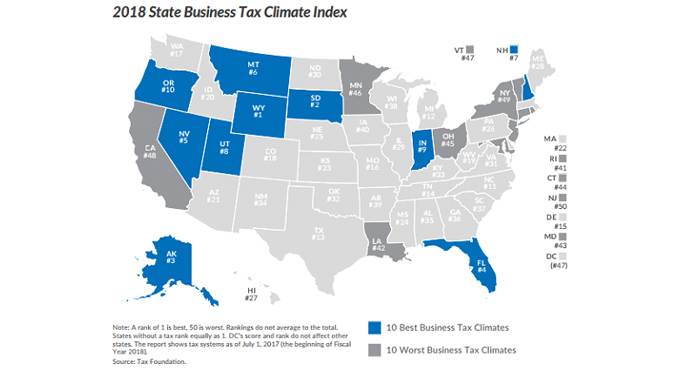

Oregon has the tenth most competitive tax code in the nation, according to the Tax Foundation’s newly-released 2018 State Business Tax Climate Index.

This annual report measures how well each state’s tax code is structured, analyzing over 100 tax variables in five different tax categories: corporate, individual income, sales, property and unemployment insurance.

The breakdown of Oregon’s 2018 ranking is as follows (first is best, 50th worst):

• Overall Tax Climate: 10

• Corporate Tax Structure: 34

• Individual Income Tax Structure: 32

• Sales Tax Structure: 4

• Unemployment Insurance Tax Structure: 31

• Property Tax Structure: 18

The Index ranks states based on their tax structure, not their tax burden. States with complex tax codes that distort business decisions do poorly, while states with transparent, neutral, fair tax codes score well.

“While the amount of revenue a state raises gets a lot of attention, it doesn’t tell the whole story about a state’s tax system,” said lead-report author Jared Walczak, a senior policy analyst at the Tax Foundation. “The goal of the Index is to start a conversation between taxpayers and legislators about how their tax system compares with other states, and provide a roadmap for improvement.”

The Index also serves as a tool for identifying state tax trends. In recent years, North Carolina, Indiana, Washington, D.C. and others have instituted reforms that have improved aspects of their tax code and boosted their Index scores. These state-level efforts provide useful lessons for the ongoing federal tax reform debate.

“Our Index shows how thoughtful reforms can improve taxes in a way that benefits all taxpayers,” said Tax Foundation Director of State Projects Scott Drenkard. “As federal lawmakers look to simplify the tax code and remove barriers to business investment, several states have already shown how tax reform could make the U.S. more competitive.”

statetaxindex.org