When COVID hit Central Oregon in April of 2020, commercial real estate in Central Oregon was impacted. Most lease negotiations came to a halt, and many sales transactions were delayed, terminated or put on hold. Miraculously, the impact was short-lived, and by the beginning of the third quarter of 2020, the Bend commercial market was back to the pre-COVID norm. The fourth quarter was above the previous year’s activity, and that positive trend has continued to rise through 2021.

A CLOSER LOOK AT EACH INDUSTRY

HOTELS: The hospitality industry suffered tremendously through the pandemic. The labor shortage extended the challenge of operating at capacity, and it is still impacting businesses today. Fortunately, landlords and government subsidies helped many in the industry survive.

RETAIL: Retail rents softened in 2020, but we are now starting to see asking rates return to normal. Compass Commercial leased over 85,000 sq. ft. since January 2021. The redevelopment of older properties continues along with new localized projects outside of downtown Bend.

OFFICE: We are noticing an increase in activity compared to 2020, but this activity is not consistent across all properties and submarkets. Some spaces experience strong activity and lease quickly after hitting the market, while others have struggled to generate interest. We believe this segment of the market is poised for a strong recovery but as of today, office leasing remains more challenged than the other property types.

INDUSTRIAL: Significant develop-ment and construction of industrial facilities have taken place in both Bend and Redmond markets. Most have been built for owner users and bridge the gamut from large manufacturing to smaller flex space for tenants to rent. Compass Commercial closed over 40 industrial leases and over 20 industrial sales in both markets so far this year.

BUSINESS: As business owners are deciding to sell to take advantage of strong valuations, we are noting an increasing number of businesses for sale.

LAND: Prices continue to increase on bare land throughout Central Oregon. We are seeing several unsolicited offers on land, particularly in Bend. The City of Bend has a limited amount of developable land inside the urban growth boundary, thus the upward pricing pressures.

IN-MIGRATION TO CENTRAL OREGON

People from virtually every state come to visit or move to the area. This in-migration has severely impacted the availability and affordability of all housing types. The demand for investors to acquire multifamily is robust, though there is little inventory available to purchase. Fortunately, the lumber prices are now coming down quickly, which will help with construction costs.

MOVING FORWARD

Central Oregon will continue to grow with more redevelopment and new construction. Investors and businesses want to be in Central Oregon, and we believe our values are still going up the left side of the bell curve.

If you have any questions regarding your properties, businesses or simply want to talk about investing in Central Oregon, contact us at Compass Commercial located in Bend.

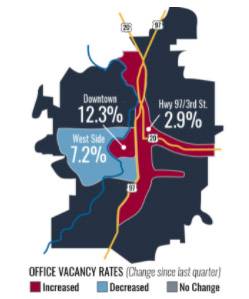

BEND OFFICE MARKET

Compass commercial surveyed 221 office buildings totaling 2.74 million square feet for the second quarter office report of 2021. 7,498 SF came back online during the quarter with the vacancy rate increasing to 7.07 percent in Q2 from 6.66 percent in Q1. There is now 193,643 SF of office space available in the market.

Leasing: The office leasing market is showing signs of stabilizing after the significant impact COVID had on leasing momentum. Activity in the West Side submarket has picked up, as evidenced by the positive absorption. Two notable leases include Western Title & Escrow leasing 14,969 SF at The Quad at Skyline Ridge and Integrated Eyecare leasing 6,600 SF at Shevlin Corporate Park. The increased vacancy rate this quarter is attributable almost entirely to G5 leaving the Downtown submarket for a smaller footprint in the Old Mill District. Their relocation contributed to the Downtown vacancy rate increasing to 12.35 percent compared to a 5.28 percent vacancy rate in Q1.

Rents: The average asking rental rate for Bend office space currently sits at $1.83/SF/Mo. NNN* with the highest rates located within the West Side submarket.

Construction: No new speculative office developments are currently under construction. At Shevlin Health and Wellness, two medical office buildings are currently under construction. The first is a 5,234 SF building expected to be occupied by High Lakes Health Care. The second, a 7,358 SF building, is currently being marketed for lease.

Sales: There were three notable office sales this quarter. The Centratel Building, located at 141 NW Greenwood Avenue, was purchased for $3,550,000 or $276/SF. A 2,276 SF single tenant office building located at 115 NW Greeley Avenue sold for $1,000,000 or $439/SF. A 1,947 SF single tenant office building located at 124 NW Franklin Avenue sold for $725,000 or $372/SF.

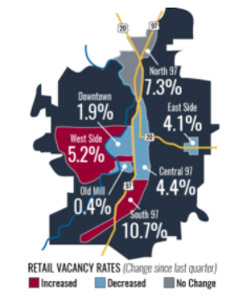

BEND RETAIL MARKET

Over 4.50 million square feet across 259 retail buildings were surveyed. During the quarter, 5,269 SF of positive absorption resulted in the citywide vacancy rate to drop slightly from 5.98 percent in Q1 to 5.86 percent in Q2. There is now 264,077 SF of available retail space for lease.

Leasing: Retail demand remained strong with 19 leases signed totaling 43,536 SF in Q2 with Compass Commercial. It should be noted, however, the quarterly vacancy rate increased to 10.66 percent in the South 97 submarket due to a correction from the previous quarter of 15,295 SF of negative absorption at the Bend Factory Stores.

Rents: The average asking rental rate for Bend retail space hovers around $2.13/SF/Mo. NNN* and is expected to be on the rise given the strong demand from a wide spectrum of retail and restaurant tenants on the search for the right location. In the West Side submarket, class A spaces leased at shopping centers and new developments throughout the market saw premiums of $2.50 to $3.00/SF/Mo. NNN.

Construction: The demand for construction has increased due to the remodel of the Bend Factory Stores, development of new retail buildings like The Grove Market Hall and tenant improvements at Westside Yard. Development continues at the new brewpub at The Quad at Skyline Ridge on Bend’s west side, consisting of approximately 3,100 SF. Construction is also slated to begin during Q3 at Reed South, a 30,000 SF retail development located at the southwest corner of SE Reed Market Road and SE 27th Street, which has Cascade Lakes Brewery pre-leasing 8,195 SF for their second location along with a gas station/convenience store.

Sales: There were three notable sales of retail buildings this quarter. A 15,154 SF retail building on Jamison Street sold to an owner user for $6,065,317 or $400/SF. Another property consisting of 5,772 SF located at 3520 N Hwy. 97 sold to an investor for $2,049,000 of $354/SF. A 3,834 SF building at 357 NE Dekalb Avenue sold to an investor for $1,141,000 or $297/SF.

INDUSTRIAL MARKET

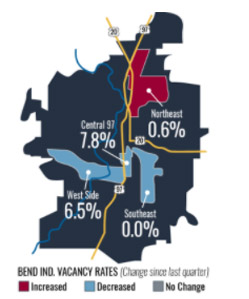

Bend

Compass Commercial surveyed 320 industrial buildings in Bend totaling 4.61 million square feet. During the quarter, 47,668 SF of positive absorption was recorded resulting in a decrease in the vacancy rate from 2.27 percent in Q1 to 1.50 percent in Q2. There is now just 69,367 SF of industrial space available for lease in Bend, compared to 104,035 SF in Q1.

Leasing: Demand for industrial space remained very high during the quarter. Compass Commercial brokers were involved in more than 53,000 SF of industrial leases in Q2 alone. The most notable leasing activity occurred in the Southeast and Central submarkets. A large lease transaction totaling 13,338 SF to a cybersecurity company at High Desert Industrial Park was completed helping to decrease the vacancy rate in the Central submarket from 11.40 percent in Q1 to 7.82 percent in Q2. Seven lease transactions were completed in the Southeast submarket during the quarter bringing the vacancy rate to 0 percent for the first time since 1993!

Rents: Average asking rates on industrial space in Bend are between $0.85 and $1.10/SF/Mo. NNN. The rental rates on the high end of the range are generally for new construction or spaces that are highly improved with office space.

Construction: Due to dwindling industrial land supply in Bend and ever-increasing construction costs, very little new speculative construction is underway. There are two projects under construction in the market totaling 25,216 SF, of which only 20,480 SF is available.

Sales: There were three notable sales of industrial buildings during the quarter. One property, located at 2548 NE 2nd Street, sold to an owner user for $1,175,000 or $143/SF. The adjacent building located at 2522 NE 2nd Street also sold to an owner user for $1,104,000 or $151/SF. Another property located at 1569 NE 2nd Street sold to an investor for $2,650,000 or $117/SF.

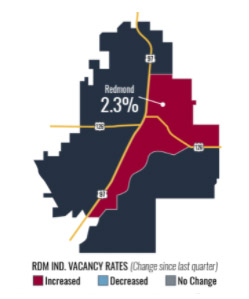

REDMOND

88 buildings totaling 1.66 million square feet were surveyed in the second quarter of 2021. In this quarter, the Redmond industrial market gained 19,874 SF of vacant industrial space increasing the total available space from only 19,000 SF in Q1 to 38,874 SF of leasable space in Q2. This is mainly due to PCC Schlosser moving out of their 33,224 SF suite at 375 NE 11th Street. The vacancy rate increased as a result from 1.14 percent in Q1 to 2.34 percent in Q2. Four buildings gained occupancy and one recorded negative absorption in Q2.

Leasing: Compass Commercial leased over 50,000 SF of industrial space in Redmond in the last quarter. ABC Supply leased 29,587 SF of this space at 833 SW 1st Street in Q2.

Rents: Average asking lease rates in the Redmond industrial market are between $0.80 and $1.10/SF/ Mo. NNN*.

*Data sourced from CoStar