(Graphics | Courtesy of Business Oregon)

Over the past two years, the focus of economic development has been on economic recovery from the COVID-19 pandemic. That has meant lots of programs and money directed at saving businesses and jobs in sectors hit hardest by the pandemic. Sectors like leisure, hospitality, arts, entertainment and recreation. Economic recovery of these sectors continues to be hampered by COVID-19 and its reluctance to leave us all alone. That said, current forecasts by Oregon Health and Science University expect COVID-19 cases and hospitalizations in the state to peak near the time you’re reading this (February 1). Cases and hospitalizations should not only start to drop but drop rapidly.

In this scenario, employment in industries like leisure and hospitality should grow rapidly in 2022. The Oregon Office of Economic Analysis forecasts employment in the state to return to pre-pandemic levels later this year — an increase of over 50,000 jobs. Artificial labor shortages caused by short-term increases in household incomes from federal aid and COVID-19 infections are expected to subside in 2022, as well as pandemic related shutdowns and restrictions, allowing Oregon to achieve this rapid growth.

Refocusing on Target Industries

Now is the time for economic development in Oregon to refocus on specific target industries to drive long-term economic growth in the state that will subsequently drive growth in sectors like hospitality, retail and entertainment. The growth of all sectors of Oregon’s economy, beyond recovery, largely rests on competitive and emerging traded sector industries.

Business Oregon, the state’s economic development agency, has utilized a target industry approach for years. The agency’s Target Industry Groups are designed to help guide the work of many teams within our organization, including those in business expansion, retention and recruitment; innovation and entrepreneurship; and global trade. The data-driven approach analyzes what industries in Oregon have established or emerging competitive advantages in the state and provide us the best opportunities for growth, innovation, high wages, competitiveness and statewide prosperity.

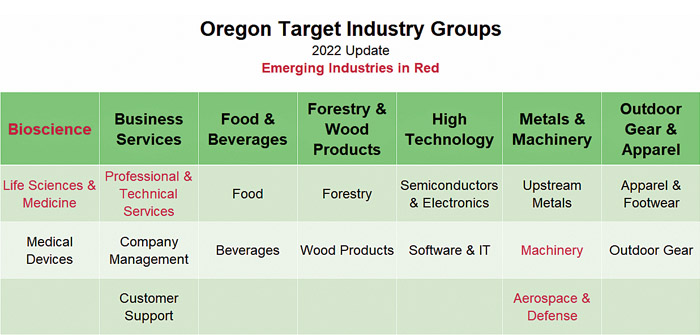

The state’s target industries are the engine of the economy, and responsible for the majority of growth, innovation and productivity that occurs in Oregon. Growth of target industries leads to higher wages, incomes and living standards throughout Oregon. Enhancing the competitiveness of these industries and helping retain, grow, and attract the quality, accessible and innovative jobs they provide should be a top priority. In December, the agency finalized an update of its Target Industry Groups, listed in Figure 1 (at top).

There are now seven Target Industry Groups in Oregon, up from six before. All Target Industry Groups demonstrate established or emerging competitive advantages in the state. Established, in this context, means the industry group, or key components of it, is larger here than average across the U.S. as a percentage of private sector employment. Emerging industries have not yet gained that level of concentration but are growing fast and gaining in size relative to the industry nationwide. Emerging industries and industry groups are highlighted in red in Figure 1.

The biggest change from the last edition is the breakout of Bioscience as its own Target Industry Group. Bioscience was included before under the old Advanced Manufacturing group, but was deemed important enough, and unique enough, to be its own, emerging Target Industry Group. While not as large and competitive as some other states, Bioscience in Oregon is growing faster and gaining market share in the U.S. Bioscience exports nearly tripled between 2009 and 2019. It is a growing part of Oregon’s innovation economy, generating exciting new research, life-changing products and increasing amounts of venture capital and foreign direct investment.

Target Industry Groups should not be thought of as “picking winner and losers” when it comes to industries of importance. Seventeen economic indicators were analyzed across all industries in Oregon that objectively point to these seven industry groups as being the most competitive. Those indicators included employment concentration, rural employment concentration, employment growth, competitive employment growth (market share gain), average wage and exports, amongst others. Minority and female employment by industry was also evaluated to ensure Target Industry Groups provide job opportunities to a diverse range of Oregonians.

It should be noted that agriculture, tourism and motion picture and sound are industries excluded from the Target Industry Groups because other state agencies and partners are tasked with their development and provide unique resources for businesses in those industries. All are important to Oregon’s economic vitality.

Comparing Target Industry Groups

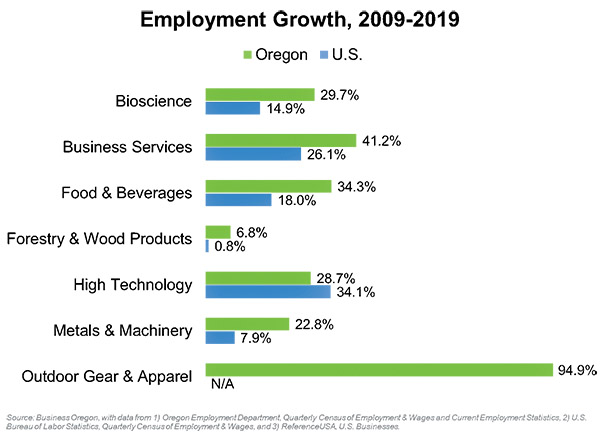

All seven Target Industry Groups offer unique advantages and strengths that differentiate them. Take employment growth, for example. Figure 2 shows the ten-year employment change for Target Industry Groups.

Figure 2

All Target Industry Groups added jobs in Oregon between 2009 and 2019, with Outdoor Gear & Apparel growing the fastest and Forestry & Wood Products growing the slowest. For perspective, total private sector employment increased 26 percent in Oregon over this period. Figure 2 also includes U.S. employment growth, which can provide insight into whether Target Industry Groups are becoming more or less competitive based on market share of employment. Based on this analysis, Forestry & Wood Products had the highest competitive employment gain, even though it had the slowest growth rate amongst the groups. This is excellent news for an industry group that has struggled to maintain competitiveness over the past three decades in Oregon. High Technology was the only Target Industry Group to see competitive employment loss in Oregon. This competitive loss was due to slower than average growth in Software & IT, which was partially offset by competitive gains in Semiconductors & Electronics. While Intel continues to invest into its facilities leading the company’s research and development in Oregon, these competitive gains could turn to losses in coming years as large expansions in Semiconductors & Electronics in other states may lead to a loss of competitiveness in Oregon’s most innovative industry.

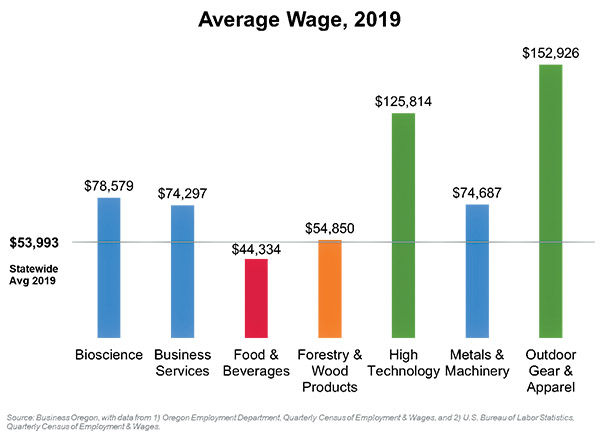

Target Industry Groups offer a wide range of average wages and accessibility for workers in Oregon. Ideally, we want to create and retain as many high wage jobs in Oregon as possible to lift household incomes, but we also want to ensure many of these jobs are accessible for workers without a Bachelor’s degree or higher — the majority of the workforce. The correlation between education and wages is clear, so Target Industry Groups offer a mix of average wages that reflect the different levels of accessibility. Figure 3 shows average wages for Target Industry Groups. Outdoor Gear & Apparel and High Technology have the highest average wages, well above the statewide private sector average. Bioscience, Business Services and Metals & Machinery also have above average wages. Forestry & Wood Products is a little above average, and Food & Beverages is a little below average.

Figure 3

COVID-19 Impacts on Target Industry Groups

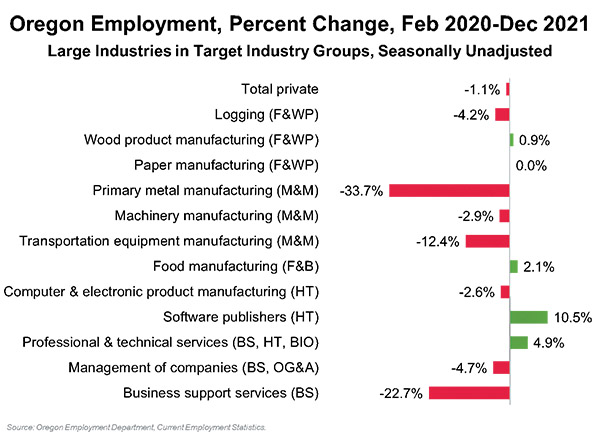

Target Industry Group analysis uses 2019 as the base year for study. Data from 2020 became available during analysis, but 2020 was a very odd year due to effects from the COVID-19 pandemic. 2019 data offers a better picture of where Oregon’s economy stood before the pandemic, and where most industries will likely be after the pandemic. That being said, the pandemic certainly impacted Oregon’s Target Industry Groups. Current Employment Statistics (CES), published monthly by the Oregon Employment Department and U.S. Bureau of Labor Statistics, offer us the most recent employment trends in the state. While current, they do not offer a fine level of industry detail. Target Industry Groups include many industries that do not appear in CES, but some larger ones do.

Since February 2020, the pre-pandemic peak for employment in the state, one Target Industry Group has felt the brunt of COVID-19 more than any other — Metals & Machinery. Amongst large industries within Target Industry Groups, primary metals manufacturing has lost the most jobs in Oregon — nearly one-third of its employment (Figure 4). Transportation equipment manufacturing, which includes aerospace manufacturing, a fast growing, emerging industry in Metals & Machinery, is also down a significant amount. It is more likely jobs lost in aerospace will return in full to Oregon and growth will continue as air travel returns to normal, but it seems less likely jobs lost in primary metals will return to their pre-pandemic peak. Some job losses in primary metals are also tied to aerospace, so some of those jobs may return as well, but others may not. Metals manufacturers tied to aerospace often specialize in advanced metals, such as titanium, and are less at risk of permanent job loss. Metals manufacturers in iron and steel products are more susceptible to permanent job loss based on recent historical trends.

Figure 4

Business support services includes call centers, which is part of the Business Services Target Industry Group. It too has suffered large job losses during the pandemic, with nearly 3,000 jobs lost since February 2020. Some of these jobs will likely return, but others may not, since call center employment in Oregon declined between 2009 and 2019 and became much less competitive nationally. In addition, 84 to 92 percent of jobs in business support services can be done remotely according to recent research by the U.S. Bureau of Labor Statistics. Whether this hurts or helps employment in Oregon is yet to be seen, but recent employment trends do not look positive.

Software and professional and technical services have added the most jobs in Oregon since the pandemic started amongst Target Industry Groups. Possible explanations for this growth include the ability of workers in these industries to work remotely and increased demand for technology products and services during the pandemic. Professional & technical services growth has been driven by architectural and engineering services, part of Business Services.

Strengths to Build On

More than anything, Target Industry Groups provide economic development professionals and businesses themselves a comprehensive tally of Oregon’s most competitive industries based on detailed, quality, objective data. These industry groups have strengths for us to build on. Business investment has not only recovered since February 2020, it has grown significantly. Directing that investment into Oregon’s Target Industry Groups will create quality, accessible jobs for Oregonians and drive growth in all sectors of the economy, leading to a stronger, innovative, more competitive economy for the state.

More information on Oregon’s Target Industry Groups can be found on Business Oregon’s website, oregon.gov/biz, along with information on funding assistance for expanding businesses and ongoing COVID-19 response and resources.