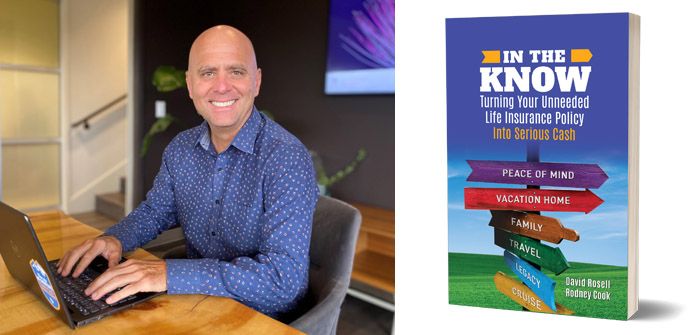

(David Rosell)

David Rosell Releases His Third Financial Book

On a muggy July day in 1984, David Rosell was helping his dad sealcoat their driveway when a neighbor asked if he would be willing to seal his. Rosell agreed and walked away with his first paycheck and an idea for a business. By the time he headed off to college three years later, he was running a profitable seal coating business with a handful of employees.

While most college students would have focused on what the money they had earned could buy them, Rosell wasn’t most kids. He credits his father and grandma for this.

“I will always remember the day my Grandma Ruth changed how I thought about money. I was 19 years old, and with great enthusiasm, I showed her the brochure of the brand-new black Honda Prelude I was planning to finance,” Rosell said.

First, she said, “Oh David, you’ll surely have the nicest car among all your friends.” Then she pulled out a chart explaining what an IRA was and the financial impact it could have on my life.

The illustration showed that if Rosell invested $2,000, the maximum IRA contribution at the time, between the ages of 19 and 27, assuming the account compounded at 10 percent per year, he would be a millionaire by age 65, even if he never placed additional contributions into the account after the age of 27. This is when Rosell truly learned to appreciate what Albert Einstein reportedly considered the world’s eighth wonder: the compound interest formula.

“My grandma taught me the difference between working for money and having money work for me,” said Rosell. “I never did buy that car. Instead, I started my IRA, a decision that would change my life.”

By the time I sold the company at age 30, we were sealing 1,200 driveways a summer and had expanded into power washing decks and siding in order to take advantage of the rainy days when we could not seal coat. “Rather than look at the winter months as a detriment, when mother nature forced us to shut down operations due to cold temperatures, I looked to this as an opportunity,” said Rosell. During the decade he ran his seal coating business, he managed to spend a month in 65 different countries around the world. He knew his next calling was to help people discover the lessons he had learned from his grandmother and share the knowledge he had acquired from watching his retirement accounts grow. By then he had figured out that people do not need to do anything extraordinary to build wealth for their retirement years. They just need to do some ordinary things (like saving a portion of every paycheck) extraordinarily well (saving a portion of every paycheck).

In 2000, Rosell began Rosell Wealth Management in Bend with the focus of guiding successful people who are at or near retirement. Over the years Rosell has written several successful books including Failure Is Not an Option- Creating Certainty in The Uncertainty of Retirement and Keep Climbing — A Millennial’s Guide to Financial Planning. His books combine his two passions; guiding people with their finances with his international travel adventures. “I enjoy taking topics that are mundane and making them fun. When people understand the impact of their choices, they tend to make better choices. When it comes to finances, most of the information out there is dry and boring, which is a barrier to people learning the tools that can help them,” shared Rosell.

One topic that people often find incredibly mundane is life insurance. Most people would rather watch paint dry than learn the ins and outs of how life insurance works. Rosell sees that as an opportunity, so much so that he recently co-authored a third book called In the Know — Turning Your Unneeded Life Insurance Policy Into Serious Cash.

“Life insurance is really interesting because just like a home, a car or a boat, it’s a capital asset that has value and can be sold. Almost nobody realizes this,” Rosell said.

His goal is to educate people about the options they have when facing decisions about what to do with their life insurance policies.

Rosell said, “up until the last few years, I thought there were only three options people had when they no longer wanted or needed their life insurance policies. There are actually four and the fourth option, called a ‘life settlement,’ can be a game changer for those who qualify.”

Rosell acknowledges that people might initially have resistance to the concept of life settlements.

“People tell me they’ve seen these late-night commercials on life settlements that come across as slimy,” said Rosell. “That’s not what we’re doing here. We’re educating people that are going to walk away with nothing or a small cash value on a powerful option that can be life-changing.”

In the Know offers guidance on:

- When it makes sense to keep a life insurance policy and when it’s time to let it go.

- Four options people have when they no longer want or need their policies.

- How selling an existing life insurance policy can potentially make a huge impact on how you live the rest of your life

The book shares real-life case studies that will blow your mind. It’s part of Rosell’s strategy to turn topics that can be boring, into topics people are excited about.

Rosell is the first Oregonian licensed in the state of Oregon to offer life settlements.

“Life insurance can be a lifeline. There’s nothing better than knowing that you can protect your loved ones even after you’re gone. If we’re lucky, however, we outlive the need for the powerful impact that life insurance can have. If that’s your story—or your client’s—this book is for you,” Rosell said.

“People do not need to do anything extraordinary to become financially independent,” Rosell said. “They just need to do some ordinary things extraordinarily well.”