Small businesses overwhelmingly support extension of the expired tax breaks known as tax extenders during Congress’s “lame duck” session, according to a new survey by the National Small Business Association.

The survey gauged the opinions of small business owners on the key issues facing the remaining days of the 113th Session of Congress as well as general sentiment about Congress.

“The biggest long-term issue small businesses say they want Congress to address is tax simplification,” said NSBA president and CEO Todd McCracken in a statement. “Small businesses need Congress to move on the tax extenders soon but keep at the top of their list for next year broad tax reform that will provide small businesses with some relief.”

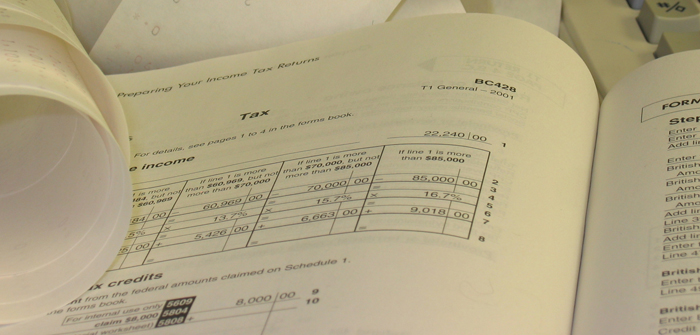

Congress has yet to deal with dozens of expired tax provisions, including the research tax credit, deductibility of state and local sales taxes, and expanded bonus depreciation.

According to the survey, the most broadly supported item for action in the lame duck session is approving spending bills, followed closely by the enactment of tax extenders and immigration reform and border control. NSBA also asked small business owners a few questions about Congress and found that not only is Congress’ inability to enact long-term, meaningful tax proposals lessening the average small-business owner’s confidence in their elected officials, it is negatively affecting nearly half of small firms’ ability to plan for the future.

“Underscoring their ongoing call for Congress to function properly, there is broad opposition among small businesses to certain procedural maneuvers such as anonymous holds and policies where leadership will only bring to the floor bills that have the support of the ‘majority of the majority,’” said NSBA chair Jeff Van Winkle of Clark Hill in Grand Rapids, Michigan.

The NSBA is urging both Republicans and Democrats to seek areas of compromise and move forward on policies that will foster entrepreneurship and small-business growth.