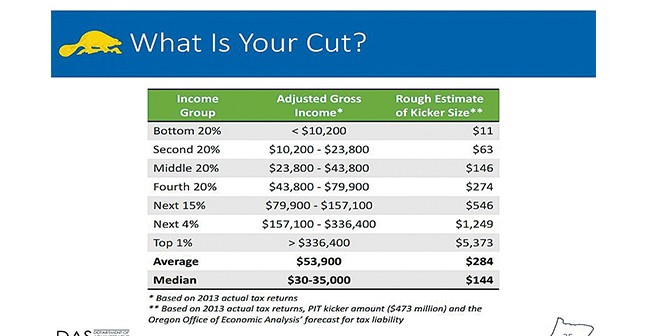

Oregon State economists recently reported a projected $402 million kicker due to a healthy revenue forecast. The estimated median rebate under Oregon’s kicker law will be $124, though the value varies significantly based on income. The average kicker refund will be $244– but not a check they can actually spend, but as an income tax credit. The top 1 percent of wage earners would receive an average tax credit of $4,600 and the bottom 20 percent will get $10.

The kicker does not come without controversy. Supporters of the kicker law insist that taxpayers should be refunded money the state determines as a surplus. Critics say it prevents the state from saving during good times to avoid budget cuts during lean times and the money should be used to build a rainy-day fund.

Because the kicker is part of the state constitution, any changes must be approved by voters.

Tax increases from 2013 and the economic recovery helped Oregon generate about 3 percent more than anticipated in personal income taxes. Oregon’s unique kicker is triggered when tax collections exceed expectations by at least 2 percent. The additional revenue is kicked back to taxpaying Oregonians. The last time it happened was 2007 when taxpayers got the largest checks in Oregon history: $600 for the average wage earner.

But again, this year the state won’t really return it, the rebate will come not in the form of a check — but on tax returns. Not only will you not see or feel the refund, but the state will be able to hold onto the funds only seeing a change next year in how much your taxes will be.

“Today’s revenue forecast shows that Oregon’s economy is holding steady but not yet reaching its full potential. Our unemployment rate is still higher than the national average and recent reports show that two out of five Oregon adults are neither working nor looking for work. Without a strong and stable workforce, Oregon will continue to face an uncertain and volatile economic future,” said House Republican Leader Mike McLane. “The best news out of the revenue forecast is the $402 million kicker that will provide much-needed tax relief for working Oregonians. When the economy does well, Oregonians should reap the benefits, not state government.”

Tax relief? Wouldn’t you much rather have a check that you could actually spend?

“I am encouraged that, overall, Oregon’s economic outlook continues to be positive and will sustain funding commitments we’ve made to schools, public safety and other important state services that support opportunities for working families,” Oregon Governor Kate Brown said. “I appreciate the foresight and prudence on the part of my legislative colleagues in ensuring a healthy ending balance that can accommodate midstream revenue adjustments.”

Taxpayers used to get checks in the mail right before the holiday shopping season, which would certainly seem to stimulate the economy especially considering $402 million. But a new law passed by the 2011 legislature means they’ll get a tax credit when they file their 2015 tax returns.

Taxpayers will get a kicker credit worth a percentage – to be determined – of their 2014 state tax bill. People with no tax liability that year are not eligible for a kicker. To claim the credit, individuals will need to file a 2015 tax return by April 15 next year, even if they have no income in Oregon that year.

Not only does the tax credit not help stimulate the economy but it will in many cases just decrease the amount of money people owe on their state and federal taxes, further reducing spending according to the Office of Economic Analysis.