Jamie Dimon, chief executive officer of JPMorgan, America’s largest bank by assets, identified emerging social and economic issues just one year ago.

His bank reported lower than expected earnings and set aside $1 billion to deal with predicted economic turmoil. He said, “Storm clouds are on the horizon. I cannot foresee any scenario where you are not going to have a lot of volatility going forward.” We can now identify the details of that prediction as they related to commercial real estate in Central Oregon.

Commercial real estate is generally one of the most reliable markets for investment but the industry follows downturns in the economy. The Counselors of Real Estate (CRE) have identified issues expected to impact all sectors of commercial real estate including:

- Inflation and Interest Rates

- Labor Shortages

- Regulatory Influences

Inflation and Interest Rates

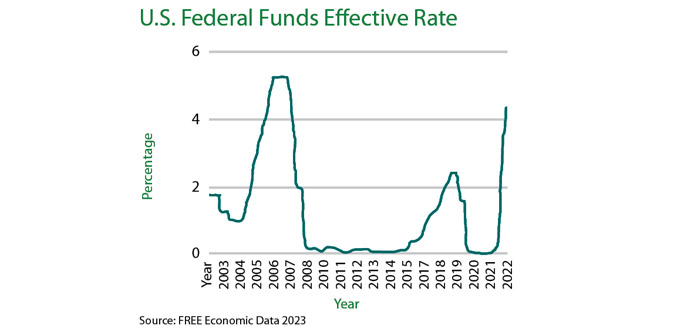

For many years, the Fed’s mandate has been to maximize employment. In the last two years, after massive Federal government stimulus payments during COVID, the U.S. Federal Reserve switched to a singular focus on inflation. CRE says, “Tightened monetary policy will place upward pressure on cap rates and market volatility. Commercial real estate transaction volume will, however, likely remain vibrant for the next year. The threats to continued economic growth include error in Fed policy.” We might have recently seen the effect of Fed policy error causing the two largest bank failures since the last recession. Many banks report their commercial loan lending practices now include a stress test on new loans to perform at a projected 7.5 percent interest rate.

Labor Shortage Strain

According to Josh Lehner at the Oregon Office of Economic Analysis, “Population growth is vital to our economic trajectory as it allows local firms to grow and expand at a faster pace.” Unfortunately, Lehner’s December 2022 report indicates a slowdown and even a population loss in Oregon over the last two years. Lehner cites possible reasons for out-migration including COVID, housing affordability and the Work-At-Home dynamic. He raises the possible impact of political influences. He says, “…a lot has been made about the relative slowdown or losses in blue states with a corresponding increase in red states.”

Central Oregon, however, is still a highly desirable location with a growing population. The Tri-County region is in the top five in Oregon for in-migration. Central Oregon’s economy is made up primarily of small businesses that depend on availability of a diverse workforce that can bring a mix of skills, strengths and experiences.

Regulatory Influences

Temporary regulations in Oregon during COVID and additional changes made to housing regulations continue to make multifamily investments less attractive for many investors. They are reinvesting in other more favorable options such as industrial and storage buildings.

The Fed’s decision to manage inflation has created pressures through the Commercial Real Estate Industry. Even with the demand for more multifamily housing, U.S. apartment sales may end this year’s first quarter at the lowest level in more than a decade as higher interest rates slowed development. According to CoStar, “Apartment sales began slowing last year as the Federal Reserve pushed interest rates up to tame inflation. Some potential buyers haven’t been able to make the numbers work with interest rates that roughly doubled.”

Another issue affecting Commercial Real Estate demand is being debated in the State Legislature. The Enterprise Zone Program is one of Economic Development of Central Oregon’s (EDCO) few remaining incentives to attract new traded sector businesses.

Oregon Economic Development Association says, “Property tax exemptions and other tax abatements are among Oregon’s best tools for expanding investment in our local communities, particularly in economically distressed areas. These local incentives are especially critical in competing for investments as Oregon does not offer grant or income tax incentives to the level seen in other states.”

Other recent reports identify political decisions that are impacting Oregon’s businesses. Walmart has announced that it is closing its two last remaining stores in Portland, costing nearly 600 jobs. This follows a closure of other individual stores like BJ’s, Stanford’s, Starbucks, Fred Meyers and Cracker Barrel who have cited reasons that include labor shortages, crime and anti-business regulatory environments.

Willamette Week’s Anthony Effinger wrote an article about the impact of political trends in Portland and Multnomah County. He says, “[Portland residents] are dodging stray bullets, losing catalytic converters to thieves and sidestepping tents. Then they open their tax bills. [Republicans and Democrats alike] are voting with their feet, getting… out of a city that once stole their hearts, driven away as taxes rise and quality of life declines. Multnomah County has lost residents for the past three years, according to Portland State University’s Population Research Center.”

Central Oregon business owners, investors and government and educational leaders can expect “storm clouds on the horizon” due to the impact of:

- Inflation & Interest Rates

- Labor Shortages

- Regulatory Influences

Each sector will make decisions as the skies darken, but hopefully will learn from others’ experiences, and see clearer skies in the near future.