We were pleased to originate $119 million in emergency Paycheck Protection Program (PPP) loans to assist clients in mitigating the effects of the COVID-19 pandemic in our Eugene/Springfield, Central Oregon and Portland Metropolitan market areas. These loans helped businesses and nonprofit entities hire back or retain thousands of Oregon employees. The Bank also saw a strong year over year improvement in the results and operations of all our teams including the Portland Metropolitan office, which opened in 2019.

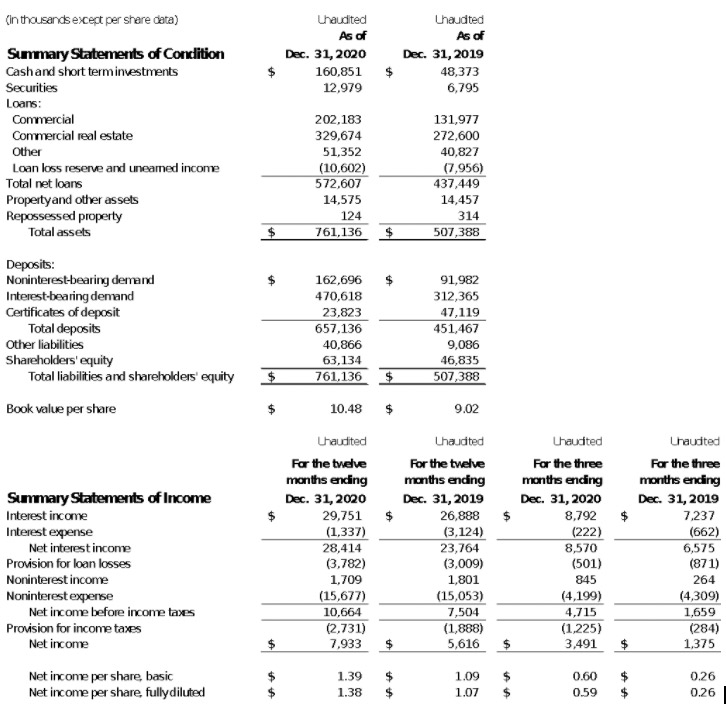

- 2020 Net Income – $7.93 million, up 41.3 percent from 5.62 million in 2019.

- $1.38 per fully diluted share, up 29.1 percent from 1.07 in 2019.

- 2020 Net Loan Growth – $76.5 million or 17.5 percent (excluding PPP loans).

- PPP loans made during Q2 2020 – $119 million of which $61 million remain outstanding at FYE.

- 2020 Deposit Growth – $206 million or 45.6 percent over FYE 2019.

“This year, we are tremendously proud to have worked closely alongside our clients, including 440 small businesses and nonprofits across Oregon under the U.S. Small Business Administration’s (SBA) Paycheck Protection Program,” said President and CEO Craig Wanichek. “This symbiotic relationship enabled thousands of Oregonians in the areas we serve to remain employed during the COVID-19 pandemic this year. We’ve had the opportunity to partner with many new clients as well and are humbled by the confidence our communities and clients have in Summit Bank.”

Summit achieved its eighth consecutive year of annual loan growth in excess of 20 percent during 2020. Total net loans (inclusive of PPP loans) as of December 31, 2020, were $572.6 million, representing a 30.9 percent increase over the fiscal 2019 total of $437.5 million. Deposit growth was particularly high during the year, with total deposits increasing by $205.7 million or 45.6 percent over the previous year. The Bank has maintained consistent profitability concurrent with its rapid growth during 2020. Summit also completed a successful capital offering during the year ($7.9 million) while achieving a return on average equity for the year of 14.3 percent. The 2020 fiscal year marked Summit’s eighth consecutive year producing a return on equity in excess of 10 percent.

Summit’s capital offering combined with strong retained earnings have added significant strength to the Bank’s capital position, with total shareholders’ equity increasing by $16.3 million to $63.1 million, an increase of 34.8 percent. Liquidity remains very strong with cash and short term investments as of fiscal year end 2020 at $160.9 million or 28.1 percent of total net loans.

The Bank continues to hold very low levels of non-performing assets with total non-performing assets at December 31, 2020 representing just 0.26 percent of total assets, down from 0.90 percent as of September 30, 2020, and a slight increase from 0.18 percent as of December 31, 2019.

Summit Bank, with offices in Eugene/Springfield, Central Oregon and the Portland Metropolitan area, specializes in providing high-level service to professionals and medium-sized businesses and their owners. Summit was recognized in 2020 as the Top Small Business Administration (SBA) Community Bank Lender in the State of Oregon. Summit Bank is quoted on the NASDAQ Over-the-Counter Bulletin Board as SBKO. QUARTERLY FINANCIAL REPORT – DECEMBER 2020