The unemployment rate for Oregon teens ages 16 to 19 was 9.5 percent in 2017, which was also the lowest unemployment rate since 1978 when comparable records began.

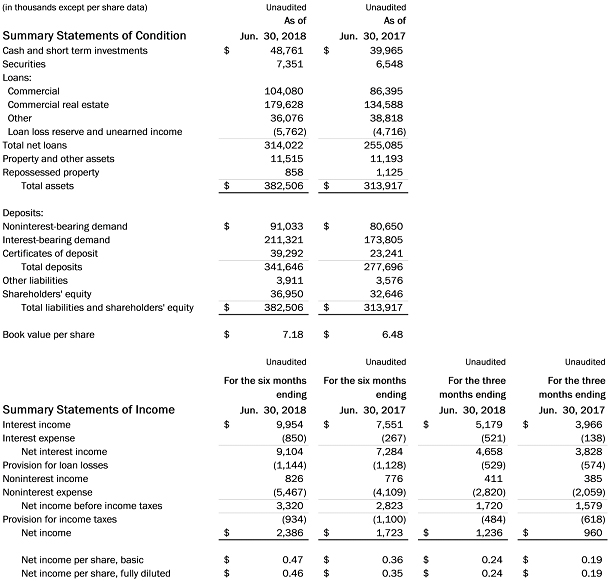

Summit Bank reported net income for the second quarter of $1.24 million, up 29 percent compared to earnings for the comparable period one year ago of $960 thousand. The Bank reported earnings of 24 cents per fully diluted share for the quarter compared to 19 cents per fully diluted share last year. Year to date earnings were $2.39 million or 46 cents per fully diluted share, compared to $1.72 million or 35 cents that the Bank earned during the first six months of 2017, representing an increase of 30 percent.

“Strong loan growth, over 23 percent year-over-year, with existing and new clients drove the increase in earnings,” said Summit Bank CEO and president Craig Wanichek. “In addition, Summit has been able to increase our depositor’s rates consistently over the past year, while maintaining net interest margin and successfully funding the growth in loans.”

Summit has achieved balanced growth in its loan and deposit portfolios over the last twelve months, with total loans and total deposits both increasing by 23 percent. Total net loans as of June 30, 2018, were $314.0 million, representing a $58.9 million increase over the second quarter 2017 total of $255.1 million. Total deposits increased by $64.0 million over the same period. The Bank continues to achieve strong earnings that support its balance sheet growth. Total shareholders’ equity at June 30, 2018, was $37.0 million, a $4.3 million or 13.2 percent increase over Summit’s June 30, 2017 total of $32.6 million.

“The Bank continues to be in a safe, sound and liquid position,” said Wanichek. “At the end of the quarter, the Bank held over $56 million in cash and securities. We were also awarded 5-Stars from Bauer Financial, the nation’s leading independent bank rating firm, which recognized Summit as one of the strongest financial institutions in the Country. Bauer measures banks safety and soundness on a five star scale.”

Earlier this month, Summit was also recognized as one of the Top Community Bank Commercial Lenders in the Country by the Independent Community Bankers Association (ICBA). The Bank was featured in the July issue of Independent Banker, which focuses on top community bank loan producers in the commercial, agricultural and consumer categories by asset size.

The Bank continues to hold very low levels of non-performing assets. Total non-performing assets at June 30, 2018 represented just 0.69 percent of total assets, an increase from 0.47 percent at June 30th 2017.

With offices in Eugene and Bend, Summit Bank is a community bank that specializes in providing high-level service to professionals and medium-sized businesses and their owners. Summit Bank is quoted on the NASDAQ Over-the-Counter Bulletin Board as SBKO. Summit is the number one community bank lender in Oregon for SBA Financing. Summit Bank was designated for the second year in a row as a 100 Best Company to Work for in Oregon, according to Oregon Business Magazine.