Harnessing the “6% Advantage”

At the cusp of entrepreneurial transition, a staggering 71% of business owners stand poised to hand over their life’s work within the next half-decade. Yet, only the astute 6% lay the groundwork for their departure two or more years ahead, setting a strategic course that is pivotal for a prosperous exit. This proactive cohort employs what we term the “6% Advantage,” a comprehensive strategy ensuring that when the moment to sell arrives, they do so with acumen, reaping the benefits of foresight and planning.

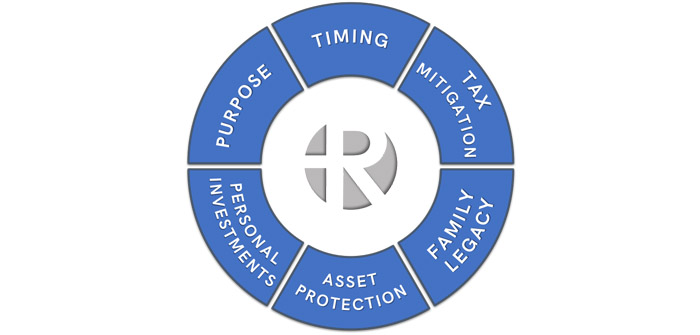

The 6% Opportunity Zones

Timing:

Timing is not just one decision but a series of them, each affecting the other. There are three critical timing opportunities that every business owner must consider:

- Pre-Letter of Intent (LOI): This is the golden hour for planning. Before any formal sale process begins, you have the most flexibility to implement strategies to enhance the value of your business, restructure for tax advantages, and shape the deal to fit your goals.

- During the Sale: As negotiations progress and the LOI is in play, your strategies pivot to solidifying deal terms that reflect your priorities, ensuring the sale structure minimizes tax impact and aligns with your objectives.

- Post Sale: After the sale, the focus shifts to wealth management and preservation, estate planning, and potentially reinvesting in new ventures. Decisions made here set the stage for your financial future and must continue the tax efficiency started earlier in the process.

Each timing opportunity has unique strategies, and if not utilized within these specific periods, their advantages are often lost forever.

Tax Mitigation

Tax considerations can significantly influence your financial outcome. Before a letter of intent (LOI) is in sight, strategies like capital gains adjustments or philanthropic giving can shape your tax landscape. But beware—the window for such tactics closes swiftly once the sale is underway, and post-sale, certain opportunities are lost forever.

Asset Protection

Astute business owners know that protecting their wealth from potential future claims is crucial. Advanced legal structuring—think family trusts or holding entities—is not just advisable; it’s a shield for your post-sale prosperity.

Family Legacy

Exiting your business doesn’t mean relinquishing your legacy. By implementing tax-efficient wealth transfer strategies, you can provide for future generations while honoring your life’s work. It’s about crafting a legacy that upholds your values and financial goals, extending beyond mere monetary gains.

Personal Investments

Personal investments are about strategically reallocating resources from the business to support your lifestyle and ambitions post-sale. The process must begin with a comprehensive assessment of your personal wealth along with your business assets. This assessment ensures that after the divestiture, your personal financial portfolio is robust, diversified, and aligned with your risk appetite and future objectives.

Purpose

Your business is more than an asset; it’s a testament to your dedication. The purpose behind its sale should reflect the legacy you aspire to leave and the life you aim to lead thereafter. Whether you’re gearing up for retirement or a new venture, anchoring your exit in purpose crystallizes your goals and steers your strategy.

Strategic Steps for Preparation

Assessing exit options, from ESOPs to strategic acquisitions, is a nuanced process requiring expert navigation. Building a dream team of seasoned professionals ensures no detail is overlooked and that your transition plan is robust, resilient, and ready for execution.

Personal finances shouldn’t be an afterthought. Collaborate with a Private Wealth Management team early to draft a blueprint for your financial future that reflects both your immediate and long-term aspirations.

Prepare for the post-sale phase. What will fill your days once the business is sold? Cultivating hobbies, social networks, and philanthropic engagements enriches this new chapter of your life.

The “6% Advantage” is your strategic ally, ensuring that the final act of your business journey is conducted with precision and leads to a rewarding future. Rosell Wealth Management is your partner in this critical process. With our guidance, each timing opportunity — from pre-LOI to post-sale — is expertly navigated, ensuring that no strategy or benefit is left on the table.

Seize the moment and make your business exit a testament to your foresight and strategic planning. Reach out to Rosell Wealth Management to activate your “6% Advantage” and transform your upcoming business transition into a legacy-defining success.

Rodney A. Cook CFP, author of In the Know — Turning Your Unneeded Life Insurance Policy into Serious Cash!, is the director of financial planning at Rosell Wealth Management in Bend. RosellWealthManagement.com. Investment advisory services offered through Valmark Advisers, Inc. an SEC Registered Investment Advisor. Securities offered through Valmark Securities, Inc. Member FINRA, SIPC 130 Springside Drive, Ste 300 Akron, Ohio 44333-2431. (800) 765-5201. Rosell Wealth Management is a separate entity from Valmark Securities, Inc. and Valmark Advisers, Inc.“Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.”