(Graph and graphic courtesy of Rosell Wealth Managment)

Many Central Oregonians are at or near retirement. I refer to this as “The Fragile Risk Zone” as contributions into 401(k)’s and IRA’s come to a halt and now they will need to live off these assets for the remainder of their lives, often two to three decades. It can be daunting to develop a plan to turn these accounts into an income stream that needs to last while they navigate the inevitable recessions and down markets that have always and will continue to be a natural part of the economy. They have worked their entire careers to accumulate these funds and there are no second chances.

As financial advisors, our objective is to guide clients to help them attain their goals with the least amount of risk. It’s okay to take risks but not foolish ones. One of the most effective ways to lessen your risk is to recognize the risks you’re running. So, let’s embark on a speed-dating course on one of the most significant and least understood risks you face in retirement — Sequence of Returns. Most investors have never been introduced to it but if you don’t account for it, it can mean the difference between having enough income in retirement and running out of money too soon. 2022 has been a year with significant market volatility however this risk could potentially impact you even more than this year’s market losses, high inflation, and interest rates.

In the accumulation phase, the focus is usually on the average of investment returns. As individuals move into the retirement distribution phase, the sequence of the investment returns should become one of the primary areas of focus as it’s critical to the overall success of the financial plan. Setbacks in the sequence of returns could potentially be the biggest hazard you will face in retirement. Often, someone will share with me their previous financial plan that was created for them. Upon inspecting it, I’ll often comment that the plan looks accurate but only if their assumptions were to become a reality. My first concern for them is that the assumed rate of return is often too aggressive for the second half of their financial journey as I’ll often see 8%, 9% and even higher returns used in projections. This concerns me as for each percentage point of higher return you are willing to assume, you take on an exponential amount of risk and there are absolutely no mulligans in retirement!

The other assumption most plans make is that they achieve this specific return in a straight-line manner- meaning if they have a proposed 8% return, they would receive this return each and every year. We know this isn’t possible. Sometimes they will experience stellar years as we did in 2019, 2020 and 2021 and not-so-happy times such as the market cycle we currently face. They may average 8% over time however when you’re in the distribution phase and starting to live off your IRAs and brokerage accounts, I’ll go as far as saying that the sequence you achieve your returns is — at least as important — if not more important than the returns themselves.

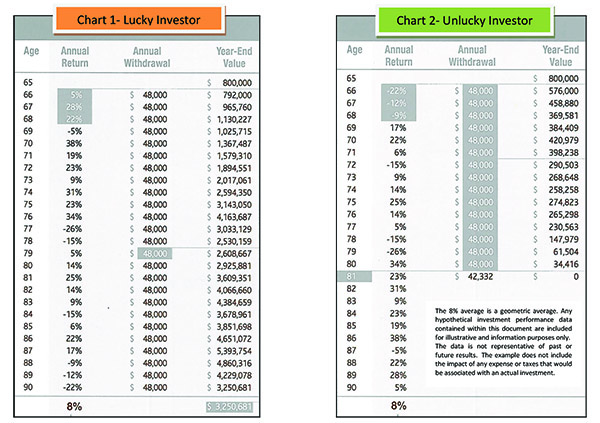

The two charts illustrate two different investors. The lucky investor on the left chart and the unlucky investor on the right. They share a great many similarities. They are 65 years of age and have account balances of $800,000 that are experiencing an 8% average rate of return. They are each taking a 6% annual withdrawal (6% of $800,000 = $48,000). One would think they would have the same chance for a successful retirement and yet the lucky investor is able to grow his account value significantly over time while taking his 6% withdrawals each year and the unlucky investor is broke just part way through retirement. How can this be? What is the difference?

The only difference between Chart 1 and Chart 2 is the sequence of the returns. I illustrated the returns using the exact same numbers but just reversed their order. Where the lucky investor began his retirement with positive rates of return: 5%, 28% and 22%, the unlucky investor experienced these same returns at the end of his life. Where the unlucky investor began his retirement with three negative years of returns; -22%, -12% and -9% the lucky investor experienced these same returns at the end of his life. This illustrates the dramatic impact of early negative market performance. As if market risk, inflation risk, interest rate risk isn’t enough of a challenge in retirement planning, WHEN one experiences gains or losses, can have a significant impact on your retirement assets. Someone who retired in 2019 may have a completely different outcome from someone who retired in 2022-even if they are invested in the exact same portfolio.

What should you take away from this? When planning for your years of financial independence, understand that using historical averages is misleading when looked at alone. Even though a portfolio may return above-average numbers, consideration must be given to when those returns took place. Be careful when an analysis states you should achieve your goals by obtaining a specific rate of return. In most cases, it has not considered the sequence of returns.

I understand that many people are exhausted and emotionally frustrated as the world recovers from the COVID pandemic, witnesses the war in the Ukraine, experiences the highest inflation in four decades while interest rates continue to spike. Unfortunately, many are immobilized and doing nothing. It’s not luck that enables people to retire, travel, and enjoy themselves. It is planning. Today, retirement planning should involve more than investment decisions. A R.I.S.K Blueprint™ creates a distribution plan with strategies to overcome these risks including ways to protect yourself from the potential of a harmful sequence of investment returns. Feel free to give me a call at the office or pick up my book Failure is Not an Option — Creating Certainty in the Uncertainty of Retirement which spells out the eight risks everyone faces in retirement and effective ways to overcome them. I wish you and your family a fun and festive holiday season.

David Rosell has been the president of Rosell Wealth Management in Bend for the past 22 years. He is the host of the popular Recession-Proof Your Retirement Podcast and author of Failure is Not an Option — Creating Certainty in the Uncertainty of Retirement, Keep Climbing — A Millennial’s Guide to Financial Planning and In The Know — Turning Your Unneeded Life Insurance Policy Into Serious Cash. Find Rosell’s books at local bookstores, Amazon, Audible as well as the Redmond Airport.

Investment advisory services offered through Valmark Advisers, Inc. an SEC Registered Investment Advisor Securities offered through Valmark Securities, Inc. Member FINRA, SIPC 130 Springside Drive, Ste. 300 Akron, Ohio 44333-2431. 800-765-5201. Rosell Wealth Management is a separate entity from Valmark Securities, Inc. and Valmark Advisers, Inc.