(Photo above courtesy of Roswell Wealth Management)

The holiday season is upon us and for many it is also a time to reflect on the past year and plan for the new one. It’s also the time of year when special memories are made with family and friends. This time of year can also be emotionally painful for those who have lost loved ones. Memories and traditions will often replay in your mind. When you smell fresh sugar cookies you think back on your late mom’s gift of baking. Your Christmas breakfast just isn’t the same without your father in the kitchen preparing it. Although these moments may bring an ache in our hearts and tears to our eyes, they will never be forgotten. The thought of leaving your spouse, children and grandchildren can even be more difficult. This may be why people tend to put off estate planning.

November 23, 2016 was my son’s 12th birthday. Sadly it was also the same day my mother-in-law passed away. She was given six to twelve months to live in August. My wife and I spoke with her a few times about planning her will. We even wrote a checklist of important steps to take before her death. As much as we tried to help her plan for her expected passing, she never did write that will. Not only are we grieving her death but we are now faced with the additional stress of beginning the process of probate. This can take up to two years and include attorney fees, significant research and of course explanations to family. It just didn’t have to be this arduous! My intention is to make the inevitable a lot easier for your children and family.

A survey completed by Rock Lawyer in 2015 found that 64 percent of Americans do not have a will in place. Not surprisingly, the number is higher for younger Americans (70% those aged 45-54). People don’t want to deal with the inevitable, that there is a 100 percent chance that they will not make it out of this world alive.

The sudden death of musician Prince is an unfortunate example of this very subject. Remembered for Purple Rain and his amazing musical abilities, he unfortunately joined other well-known names such as, Bob Marley, Pablo Picasso, Martin Luther King Jr. and Abraham Lincoln who did not have an estate plan in place. They all died intestate, meaning without a will or trust to protect their loved ones. Sadly, Prince’s family is now publicly fighting over his estate.

A will spells out who will receive your assets along with who will serve as the executor─ the person you designate to help ensure it’s all handled properly. Not only can’t you choose your beneficiaries of your estate without a will, you can’t dictate the person you want to manage your affairs. You can’t plan to reduce or eliminate inheritance, estate or income taxes. Simply put: without a will, you typically have no control over your assets at death.

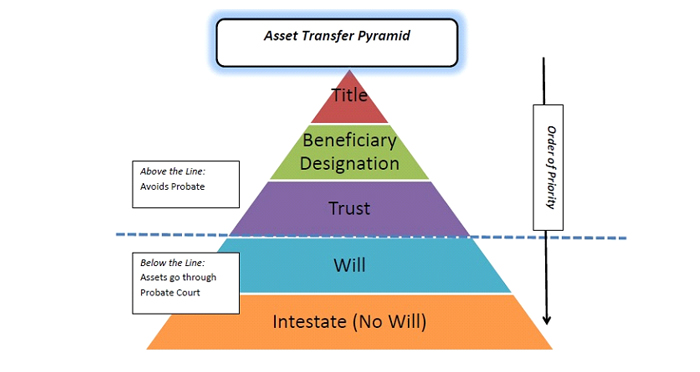

Regardless of the size of your estate, planning is always recommended. I will layout the basic Estate Planning triangle from the top down.

⦁ Title: Properly titling your assets can eliminate wealth transfer issues. Examples: Are your assets held in a joint name with your spouse or as an individual?

⦁ Beneficiary Designation: The primary beneficiary (or beneficiaries) inherit first. If they have predeceased you or if they die with you, your assets would instead go to any secondary beneficiaries you have designated. These secondary beneficiaries are often referred to as contingent beneficiaries on account forms.

⦁ Trust: A Living Trust is a document you establish to own your assets. While you still control the assets during your lifetime, the assets will avoid going through probate when you die and will be distributed to your family members. (Note: a trust must be funded creating the document is not all that is required, please talk to a trust lawyer for further instructions)

⦁ Will: As I shared above, This is where you direct to whom, when, and in what amounts your assets will be distributed. With a will, it is still necessary to work through the probate courts.

⦁ Intestate (No will): The act of dying without a legal will. Determining the distribution of the deceased’s assets then becomes the responsibility of a probate court.

⦁ Probate: This is a legal process that takes place after you die. It typically involves paperwork and court appearances by lawyers. The lawyers and court fees are paid from estate property, which would otherwise go to your family members.

Whatever your reason may be for delaying completing a will, think about the ramifications if you don’t. Your hard-earned investments and possessions become vulnerable and your family is almost guaranteed to suffer additional loss. Start the conversation today, seek the assistance of a certified estate planner and give yourself and your family the peace of mind that nurtures fond memories. Have a wonderful holiday season!

Rodney A. Cook CFP® is the Director of Financial Planning at Rosell Wealth Management in Bend. www.RosellWealthManagement.com.

Investment advisory services offered through ValMark Advisers, Inc. an SEC Registered Investment Advisor

Securities offered through ValMark Securities, Inc. Member FINRA, SIPC 130 Springside Drive, Ste 300 Akron, Ohio 44333-2431. (800) 765-5201. Rosell Wealth Management is a separate entity from ValMark Securities, Inc. and ValMark Advisers, Inc.