(Graph | Courtesy of Mid Oregon Credit Union)

Looking at the economic picture at the start of 2024, we continue to see the influence of the “Central Oregon Effect” on local conditions. Our robust business climate, the health of the construction and tourism industries, tight labor market, and the inflows of both businesses and households to our region continue to insulate us from some of the negative trends happening in other areas of the state.

Population growth has a lot of impact on economic growth. Over time, an economy can only grow as fast as its labor force. Oregon is on the wrong side of the equation in aggregate, but Central Oregon’s population has continued to grow. If this continues in 2024, Central Oregon may avoid negative impacts from the mild recession that economists are predicting for 2024.

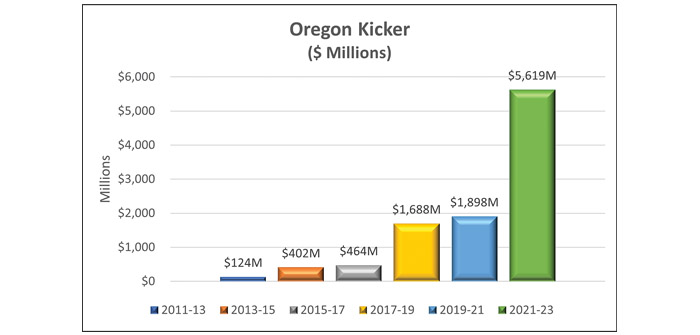

Our region remains a desirable place to move a family or business, despite the housing affordability challenges we face. Another expected bright spot for our local economy in 2024 is the Oregon “kicker” rebates. The 2021-23 historical kicker surplus should inject about $500 million into the Central Oregon economy in early 2024. The combination of healthy population growth and the kicker stimulating activity may result in a better overall outlook for our local area as it faces recessionary pressures.

With nearly 47,000 members, Mid Oregon Credit Union serves about one in nine Central Oregon households across nearly all income and demographic categories. The financial decisions of our members provide some key insights into Central Oregon’s economy.

Mid Oregon members are spending less and saving more — behaviors we would typically associate with people anticipating weaker economic conditions. The impact of inflation, particularly on low- and middle-income households, is also undeniable. However, 2023 was a great year for savers, as rates of return on deposits were higher than at any time since 2005. Deposit rates should continue to be favorable well into 2024.

Of course, the opposite side of higher deposit rates is higher loan rates. We expect borrowers to see some relief later in 2024, but people should not expect another opportunity to lock in a 3% mortgage rate any time soon. In terms of larger purchases, 2024 is likely to provide some relief from higher prices, especially for cars and trucks. Prices are trending downward, and consumers may find a great price on a vehicle in 2024, which should help offset higher financing costs.

This year may also be a good opportunity to look for a home. Median sales prices for homes in Bend declined by 2.2% in 2023. Although inventory is still tight, mortgage rates have dropped back below 7%. This should help more Central Oregon households looking to buy a first home or trade up to a larger home. Prices for food, energy, and consumer goods should continue to moderate in 2024, potentially allowing the Federal Reserve to reduce interest rates and helping consumers to adjust to higher prices on everyday living expenses.

At Mid Oregon, we appreciate our role as Central Oregon’s only locally headquartered financial institution. Having recently been named the #1 credit union in Oregon by Forbes, we take our role in the local economy very seriously.

Choosing a local option for your financial business makes a difference. The deposits our members entrust us with are reinvested in Central Oregon and circulate numerous times in our local economy — helping people buy homes and vehicles and helping businesses grow and thrive.

Through multiple ups and downs in our local economy since our founding in 1957, Mid Oregon has remained strong, supporting local residents and businesses, and helping them achieve their financial dreams. One hundred percent of Mid Oregon employees are Central Oregonians, and no one is more committed to preserving the “Central Oregon Effect” than the Mid Oregon team.