I recently did the math and if I live into my mid 90s I have already entered middle age. Let’s face it- it’s easy to exercise a little less as work becomes more demanding and let our eating habits slide just as our metabolism simultaneously slows down. At the beginning of the year I made the decision that I was not going to let an old person inside!

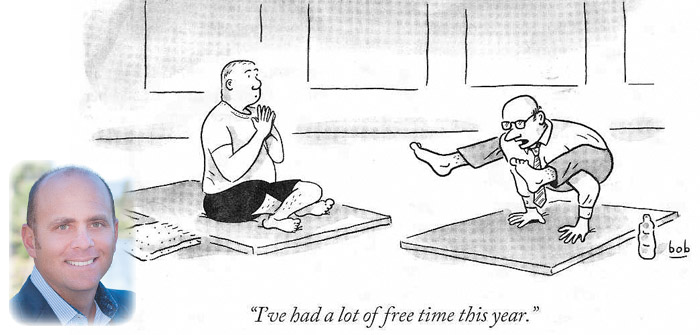

In January, I signed up for a month of unlimited Hot Yoga. The classes consist of a series of 26 demanding postures and are held in a room that’s been heated to 105°F. Having the flexibility of the Tin Man, stretching has never been my thing. When I entered the room for the very first time a gush of hot, humid air rushed through me. If you can imagine a tropical island with no breeze, you’ll start to get the picture. It smelled of sweat, breath and heat. An overwhelming feeling of intimidation and asphyxiation took over as I pressed forward taking a spot on the floor in the back of room.

Before long the friendly instructor had me attempting to balance on one leg with the other leg crossed over the other – my arms intertwined. Sweat started instantly, dripping profusely onto my mat. Before long the towel that I was laying on no longer provided any drying properties. My primary goal at this point was to just stay in the room for the entire 90 minute class.

I have been at it for two months now and I must say I have started to not only experience the profound benefits from yoga but actually enjoy the classes in an unexpected way. While recently resting at the end of a class, I started thinking how my initial fears of yoga have a lot in common with how many people feel about investing.

1) Just as I was overwhelmed with the heat many investors feel beleaguered when it comes to choosing the myriad investment options inside of their company retirement plans. For many investors I recommend target-date funds. As their name suggests, they have a target date for retirement. This strategy makes a complicated scenario — how to invest over 30 or more years — simple. Or at least simpler.

These funds start out more heavily weighted in equities, then grow more conservative as your retirement date draws closer. Speaking of simplification these target-date funds take the responsibility for rebalancing out of the investors’ hands. Even if investors do a great job of picking the right funds initially, it’s unlikely they’re going to review and rebalance them every quarter. They can be a great long-term solution for people who want a highly diversified portfolio and professional investment management with a “set it and forget it” approach.

2) As my objective was to stay in the room for the entire class no matter how physically and mentally grueling it became, it is important to have a similar objective with your investments for retirement and stay the course. Many choose to time the markets. I was recently introduced to a gentleman who shared his perceived success story of such market timing. In an excited tone he explained how he liquidated his entire equity portfolio in October of 2007 when the Dow Jones Industrial Average was near its peak-closing price at that time of 14,164.

He went on to give details about how the Dow hit a market low of 6,443 on March 6, 2009, having lost over 54 percent of its value since the October 2007 high. I asked him when he got back in the market. He stated in a less fervent tone that he had not done that yet as he was waiting for the markets to decline first. I informed him that the markets had since experienced momentous growth and the Dow has more than recently achieved a new all-time high breaking the 18,000 mark. I didn’t have to add that he had lost out. By the time I was done, he knew.

When you time the markets you have to be lucky twice. You must not only get out of the markets at the right time but you need to get back in at the right time. This gentleman was lucky once but not twice, and consequently now faces a serious dilemma. To be successful over the long term, it is time in the markets not timing the markets that counts.

3) Such an intense workout in a searing room caused an unsettling feeling of asphyxiation. Most investors felt the same way in 2008, experiencing one of the worst market downturns in many of our lifetimes. It is important to put such an occurrence into perspective by accepting that our economy averages a recession about every nine years.

The good news is there has never been a down real estate or stock market that hasn’t bounced back to hit an all-time high. Of course past results do not guarantee future performance. Staying calm amid market turmoil is not easy. Fears of further decline can make investors feel skittish. This is absolutely the wrong time for investors to panic and throw in the towel. The cost of missing a market rebound could be significant.

The last yoga position is called Savasana. Lying on the back, the eyes are closed and the breath deep. It is intended to rejuvenate body, mind and spirit. I feel relaxed and confident. Just like your body- when your financial house is in order it can lead to a lifetime accentuated by a certain calming and peace of mind that is truly priceless. Most people desire financial freedom. There is no magic solution, no one way to achieve physical or financial success. Having a plan in place can help you create greater certainty around the uncertainty of retirement. The hoped-for reward is living the life you have always imagined during your years of financial independence and of course achieving peace of mind.

David Rosell is president of Rosell Wealth Management in Bend. He is the author of Failure is Not an Option- Creating Certainty in the Uncertainty of Retirement. You may learn more about his book at www.DavidRosell.com or Amazon.com. Ask for David’s book at Barnes & Noble and in Bend at Newport Market, Cafe Sintra, Bluebird Coffee Shop and Powell’s Books in Portland.

Investment advisory services offered through Rosell Wealth Management, a State Registered Investment Advisor. Securities offered through ValMark Securities, Inc. Member FINRA, SIPC 130 Springside Drive, Ste 300 Akron, Ohio 44333-2431. 800-765-5201. Rosell Wealth Management is a separate entity from ValMark Securities.