(Traveling Bolivia’s DEATH ROAD, The World’s Deadliest | Photo Courtesy of Rosell Wealth Management)

Graham Brown said, “Life is about choices. Some we regret. Some we’re proud of. Some will haunt us forever. We are what we choose to be.” I learned this lesson the hard way back in 1996 when I ran my seasonal driveway sealing business and had winters off. I headed down to South America with my backpack, one-man tent and camping stove for a six-month sojourn that found me in the beautiful country of Bolivia. In my years of wandering the globe, I have found the risks of adventure travel often parallel the risks that we face as investors. Any journey — financial or otherwise — can be risky. If you’re a seasoned traveler, you can mitigate these risks by having the right tools and a detailed plan in place. The last thing you want is to invite those risks that could be avoided.

The first glimpse of La Paz will, literally, take your breath away. At an elevation of almost 12,000 feet above sea level, it’s the world’s highest capital city. An estimated 800,000 Bolivians live inside the bowl-like depression that is the caldera of an enormous volcano and is surrounded by the snow-capped Andes reaching heights greater than 18,000 feet. The topography ranges from very high mountains to barren plains to lowland rainforests. It wasn’t until I traveled to the most humid place I had ever experienced — the Amazon Basin, located 260 miles to the north — that I truly acquired a sense of how incredibly wide-ranging the landscape is. I also didn’t have the slightest idea that I was in for the longest, spine-chilling crossing of my life. YES, I risked my life on a Bolivian bus to save a mere $60! A Bolivian man warned me not to take the 18-hour bus ride from La Paz to Rurrenabaque. “Flying is much safer,” he stated. But as a 26-year-old backpacker with months of the journey left, I was motivated by a propensity for adventure and the desire to save my precious dinero. This bus ride would take me on the world’s most treacherous thoroughfare that connects the heights of La Paz to the rainforest at sea level. It’s ominously known as the Death Road.

An estimated 300 people are killed on this road every year as buses plummet into the valley on a monthly basis. Luckily—or unluckily depending on your perspective— I didn’t know that at the time. Surrounded by vertical mountain precipices and overhangs, the snaky, dirt road had been cut into the side of the Andes in the 1930s by prisoners. Today it’s still one-and-a-half lanes of rutted dirt, gravel and water-filled potholes. How can this be a one-way thoroughfare? I wondered. It wasn’t! Terrified does not even begin to explain the sheer panic I felt as the sheer cliff face dropped 1,800 feet into a verdant abyss to my left. No guard rails. No reflectors. No sanity! I felt as if I was riding the X2 rollercoaster at Magic Mountain without a lap restraint. It was going to be a sleepless night.

With every switchback, I gazed down into the foggy valley and held my breath. If that wasn’t scary enough, an old, battered truck came around one of the never-ending blind bends. Apparently, we drew the short straw as one of the locals hopped off the bus and began to guide our bus backwards so the truck could sneak by. Suddenly the people at the back of the bus started shouting trying to get the driver to stop. Instead, he kept reversing. As fellow passengers became more and more panicked, I took an enormous breath and told myself, It’s not my time yet.

After the most terrifying 18 hours of my life, I felt like kissing the muddy red earth when our bus finally reached our destination. I was relieved beyond words to NOT be a permanent part of the Bolivian landscape. I had survived the Death Road! So all these years later I have to ask myself: What was I thinking? Could I have gotten there in a way that was much safer? Of course, I could have. I knew that I had no control of the bus as it puttered through the road from hell. I also realized that while I couldn’t do anything to change the outcome of whether we would survive, deciding to get on the bus in the first place had been all me.

This is also the name of the game in the financial world where the objective is to attain our goals with the least amount of risk. It’s okay to take risks but, not stupid ones. One of the most effective ways to lessen your risk is to recognize the risks you’re running. So, let’s embark on a speed-dating course on one of the most significant and least understood risks you face in retirement — Sequence of Returns. Most investors have never been introduced to it but if you don’t account for it, your years of financial independence could suck just as my 18-hour journey did. Aside from market risk presenting challenges to retirement planning, like we’re currently facing with COVID 19, sequence of returns can have a significant impact on your financial future because it is how you experience gains or losses or the order in which you receive your returns. Either one can mean the difference between having enough income in retirement and running out of money too soon. The transition from the retirement accumulation phase during your working years to the retirement distribution phase creates a clarifying and critical change.

In the accumulation phase, the focus is usually on the average of investment returns. As individuals move into the retirement distribution phase, the sequence of the investment returns should become one of the primary areas of focus as it’s critical to the overall success of the financial plan. Setbacks in the sequence of returns could potentially be the biggest hazard you will face in retirement. Often, someone will share with me their previous financial plan that was created for them. Upon inspecting it, I’ll often comment that the plan looks accurate but only if their assumptions were to become a reality. My first concern for them is that the assumed rate of return is often too aggressive for the second half of their financial journey as I’ll often see 8 percent, 9 percent and even higher returns used in projections. This concerns me as for each percentage point of higher return you are willing to assume, you take on an exponential amount of risk and there are absolutely no mulligans in retirement!

The other assumption most plans make is that they achieve this specific return in a straight-line manner — meaning if they have a proposed 8 percent return, they would receive this return each and every year. We know this isn’t possible. Sometimes they will achieve stellar years as we did in 2019 and not so happy times such as the market cycle we currently face. They may average 8 percent over time, however, when you’re in the distribution phase and starting to live off your IRAs and brokerage accounts, I’ll go as far as saying that the sequence you achieve your returns is at least as important — if not more important — than the returns themselves.

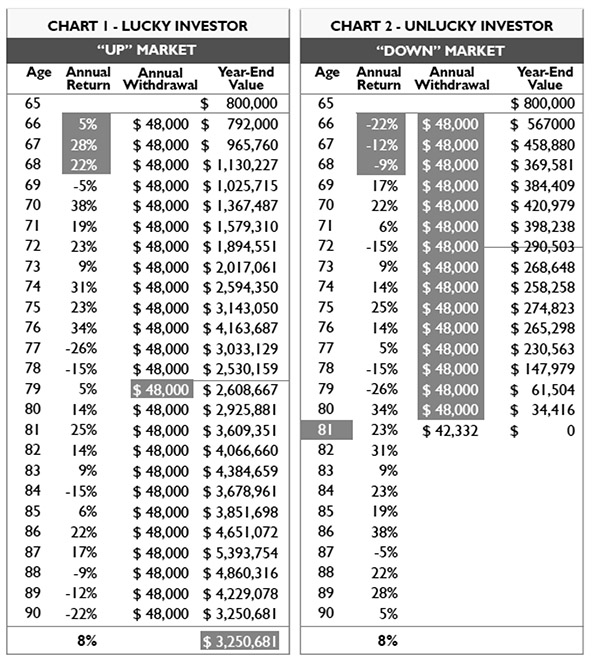

The two charts illustrate two different investors. The lucky investor on the left chart and the unlucky investor to the right. They share a great many similarities:

- They are each 65 years of age and have account balances of $800,000 in their IRA.

- Their accounts are experiencing an 8 percent average rate of return.

- They are each taking a 6 percent annual withdrawal (6 percent of $800,000 equates to an annual income stream of $48,000 from this account).

One would think that they would have the exact same chance for a successful retirement, and yet the lucky investor is able to grow his account value significantly over time while taking his 6 percent withdrawals each year while the unlucky investor is broke just part way through retirement. How can this be? What is the difference? The only difference between Chart 1 and Chart 2 is the sequence of their returns. When you take a look at the charts you’ll see that the returns share the exact same numbers, I just reversed their order. Whereas the lucky investor began his retirement with positive rates of return — 5 percent, 28 percent and 22 percent — the unlucky investor experienced these same returns at the end of his life. Whereas the unlucky investor began his retirement with three negative years of returns — -22 percent, -12 percent and -9 percent — the lucky investor experienced these same returns at the end of his life.

I find most investors are unaware that experiencing negative returns early in retirement distribution can have a potentially devastating impact on account balances. The fact is that in retirement, the difference between success and failure often comes down to the timing of returns. What should you take away about this relatively unknown and potentially lethal financial risk?

- When planning for your years of financial independence, understand that using historical averages is misleading when looked at alone. Be careful when an analysis states that you should achieve your goals by obtaining a specific rate of return. In most cases this statement has not taken into account the sequence of returns.

- It can be dangerous to have a retirement projection using a straight-line rate of return without factoring in bad timing. Even though a portfolio may return above-average numbers, consideration must be given to when those returns take place.

To learn effective ways to help remove Sequence of Returns Risk tune into episodes 7 and 8 of my podcast: Recession-Proof Your Retirement. So the next time you consider making a large risk for a small payout, consider my experience on Bolivia’s death road and think twice before doing something you might regret.

David Rosell is President of Rosell Wealth Management in Bend. rosellwealthmanagement.com. He is the creator of the podcast Recession Proof Your Retirement and author of Failure is Not an Option — Creating Certainty in the Uncertainty of Retirement and Keep Climbing — A Millennial’s Guide to Financial Planning. Find David’s books on Audible and iBooks as well as Amazon.com and Barnes & Noble. Locally, they can be found at Newport Market, Sintra Restaurant, Bluebird Coffee Shop, Dudley’s Bookshop, Roundabout Books and Sunriver Resort.

The examples given are hypothetical and are for illustrative purposes. Actual results may vary from those illustrated. Investment advisory services offered through Valmark Advisers, Inc. an SEC Registered Investment Advisor Securities offered through Valmark Securities, Inc. Member FINRA, SIPC 130 Springside Drive, Ste. 300 Akron, Ohio 44333-2431. 800-765-5201. Rosell Wealth Management is a separate entity from Valmark Securities, Inc. and Valmark Advisers, Inc.