Over the past few weeks, we have been highlighting fraud schemes that target the elderly… and for good reason. A national law enforcement sweep over the course of the past year has shown that seniors are prime targets for criminals. Why? Because they tend to be financially stable, to be trusting and to be reluctant to say “no.”

As Americans grow older, it is common to want to solidify the financial nest egg you have or to tap into the equity you’ve built up to keep you and your family in a comfortable lifestyle.

That’s where today’s topic comes in — real estate fraud. Reverse mortgage frauds, also known as home equity conversion mortgages, are one of the most popular real estate scams we see.

A legitimate home equity conversion mortgage is insured by the Federal Housing Authority or FHA. It allows eligible homeowners to access to the equity in their homes by providing funds without the homeowner having to make a monthly payment.

When a fraudster finds a senior who is not familiar with the requirements or the process – or who is in desperate need of a steady stream of cash — the results can be devastating. Unscrupulous professionals in a variety of real estate, financial services and related companies will work to steal the equity in your home.

Another kind of real estate scam involves using seniors as straw buyers. The criminal wants to buy a house, but — for whatever reasons — says he can’t get approved for the purchase. Maybe you agree to sign the papers for him as a favor, or maybe you think you will earn a few thousand dollars bonus. The criminal could be a real estate agent, lender, appraiser, investor or new friend. In the end, the bad guy often ends up skimming the equity and leaving you holding a hefty 30-year mortgage with potential criminal liability.

In other related real estate scams, the criminals may offer the victims free homes, investment opportunities or foreclosure and refinance assistance. The result is often the same – you lose that cherished nest egg and your credit history is in ruins.

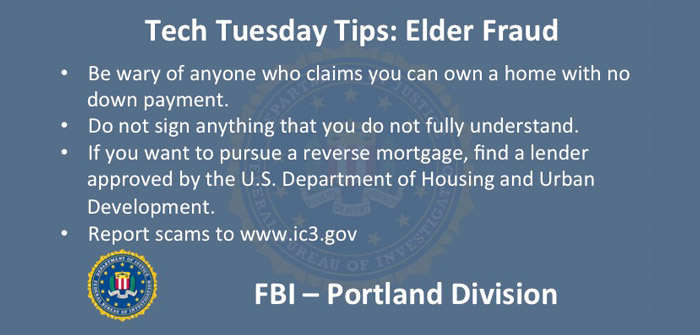

Here’s how you can protect yourself and family members:

- Don’t respond to unsolicited ads.

- Be suspicious of anyone saying you can own a home with no down payment – or flip a house by signing for a mortgage you don’t want.

- Don’t sign anything that you do not fully understand.

- Don’t accept payment for helping someone else to buy a house that you do not intend to live in.

- If you want to pursue a reverse mortgage lender, seek out one who is approved by the U.S. Department of Housing and Urban Development.

Next week, we will wrap up our series on elder fraud with telemarketing fraud and sweepstakes scams.

If you have been victimized by an online scam, report your suspicious contacts to the FBI. You can file an online report at the FBI’s Internet Crime Complaint Center at ic3.gov or call your FBI local office.